Maduro and Greenland fail to rain on markets' parade

Despite high-profile geopolitical events and headline risk, global markets started 2026 on a resilient footing, supported by solid economic fundamentals and growth momentum.

The themes that dominated markets last year have carried into the new year, dispelling any expectation that 2026 would be ‘quieter'. The US’s audacious extradition of Nicolás Maduro from Venezuela and President Trump’s announcement to pursue the acquisition of Greenland have reinforced this dynamic.

Arrange your free initial consultation

Once again, we see a clear divergence between the prevailing narrative ‘the noise’ and what is happening in financial markets. Despite these headline grabbing risks, which ultimately proved to be temporary flashpoints, global equity markets were buoyed by stronger growth expectations and a macroeconomic backdrop that remains broadly supportive. In this environment, economic resilience has helped offset lingering inflation concerns.

Equities

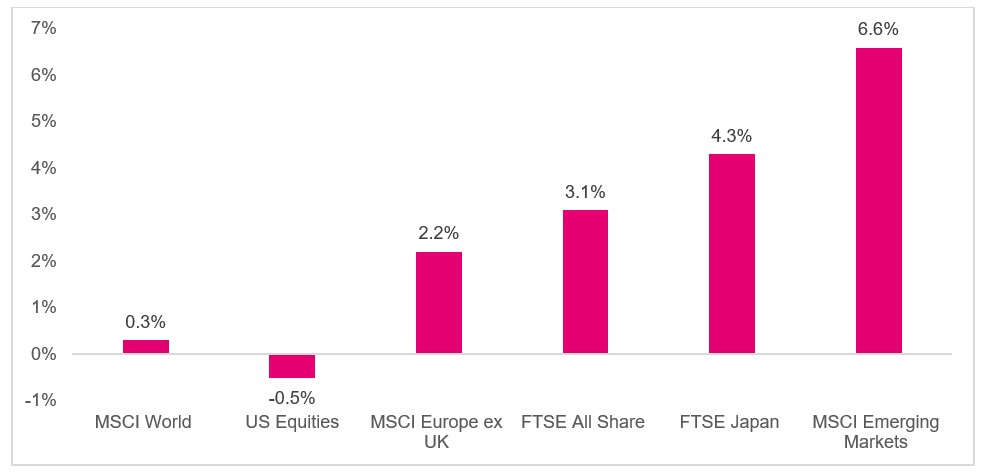

Figure 1. Equity market returns (January 2026, Source: Pacific Asset Management)

Equity markets were broadly positive across regions, although US equities lagged as technology stocks came under pressure. Microsoft notably fell 10% in a single day, highlighting growing investor caution over elevated valuations and increasing scepticism regarding the scale of spending on AI and related projects.

US policy uncertainty increased with the nomination of Kevin Warsh as the next Federal Reserve Chair, set to succeed Jerome Powell in May. Front-runner Kevin Hassett was ultimately passed over, partly due to concerns over his perceived political alignment amid scrutiny of Fed independence. Warsh’s appointment was broadly welcomed, but questions remain given his past reputation during his previous tenure at the Federal Reserve as an inflation hawk - prioritising price stability - and how this will align with President Trump’s preference for lower interest rates, leaving markets watching closely how his approach will unfold.

European equities ended the period higher, despite earlier pressure from President Trump’s threat to impose tariffs on European countries over Greenland. Sentiment improved as tensions eased, supported by stronger-than-expected Q4 2025 GDP growth of 0.3% and a near record-low unemployment rate of 6.2% in December.

In the UK, the FTSE 100 surpassed 10,000 points for the first time since its launch in 1984, led by basic materials benefiting from higher metal prices. Domestically focused companies maintained positive momentum, with mid-cap stocks outperforming large caps. Inflation rose to 3.4%, the first increase in five months, leaving the UK with the unenviable record of the highest inflation in the G7. Markets continue to view this as largely transitory, driven by factors such as higher airfare over the Christmas period, and expect inflation to gradually return toward the 2% target.

In Japan, equities continued to rise following the announcement of a snap lower house election on 8 February, called by Prime Minister Sanae Takaichi to strengthen her mandate and support her agenda of easier monetary policy and targeted fiscal stimulus.

Fixed income

Government bond markets came under pressure as stronger-than-expected economic growth and concerns over elevated public spending dampened expectations for near-term policy easing, pushing yields higher. US Treasuries fell, especially at the short end of the curve, as robust data delayed anticipated Federal Reserve rate cuts. UK gilts also declined, with December inflation coming in above expectations, reducing the likelihood of further easing from the Bank of England. European government bonds were relatively resilient, led by France and Italy, supported by improved risk sentiment across core and peripheral markets. In Japan, government bonds faced significant pressure, recording a particularly challenging start to the year as yields adjusted to evolving domestic policy expectations.

Figure 2. Fixed Income returns (January 2026, Source: Pacific Asset Management)

Figure 2. Fixed Income returns (January 2026, Source: Pacific Asset Management)

Commodities

Commodity markets extended their positive momentum early in the year, underpinned by strong gains in precious metals and oil. Gold performed well through most of the month, buoyed by sustained central bank buying particularly from emerging-market reserve managers and heightened geopolitical tensions that supported safe-haven demand. However, the metal sold off late in the period as speculative positioning shifted and investors took profits from earlier strength. Brent crude oil also advanced, holding near multi month highs as ongoing supply risk concerns continued to provide support to energy prices.

Portfolio implications

The start of the year has reinforced the case for international diversification, with opportunities increasingly emerging outside the US. Uncertainty is likely to continue - the classic ‘known unknown’ - requiring investors to remain proactive and adaptable in navigating the evolving market landscape.

If you have any questions or concerns about your investments or your future plans, don’t hesitate to get in touch with your TPO Adviser or contact us centrally through our website.

Arrange your free initial consultation

This information in this article is correct as at 13/02/2026.

This market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.