Chancellor’s Spring Statement: growth halved, but no tax changes

The Chancellor previously confirmed that she only wanted to make major tax and spending announcements once a year, with this being in the Autumn Budget. Therefore, no tax changes were expected and none were delivered.

The headline from the speech was that the Office for Budget Responsibility (OBR) has halved its 2025 growth estimate for the UK from 2% to 1% in 2025, but it has upgraded its longer term forecasts from 2026 onwards.

Alongside this, previously announced cuts to Welfare and Overseas Aid payments, Increases in Defence spending and Planning Reforms were confirmed.

In terms of signposting future changes that could be announced:

- The government confirmed it is looking at options to reform ISAs to “get the balance right between cash and equities to earn better returns for savers” which could indicate limited cash ISA allowances relative to Stocks and Shares ISA allowances.

- The government will also be holding a series of roundtables with key stakeholders over April as it considers the role of tax reliefs for Enterprise Management Incentives Schemes, Enterprise Investment Schemes and Venture Capital Trusts.

|

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. |

|---|

After the pension changes over the last few years and, in particular, last year’s confusion as the new pension rules were ‘bedded in’ and legislation adjusted, it was a relief to have no further tinkering with pension rules.

We already know of course, of various areas of impending change, including the removal of the ‘domicile’ tax regime from 6 April this year, the Business Property Relief and Agricultural Property Relief changes from April 2026 and of course the Pensions and IHT changes from April 2027 – which we await further details on.

These areas and others, including the employer National Insurance increases, are covered off in our Autumn Statement 2024 summary.

There were some changes announced to Universal Credit from 2026 onwards and from this summer it will become possible for those newly liable for the High Income Child Benefit Charge to pay the tax through PAYE rather than via self-assessment.

If you’d like to discuss any of the announcements from the Spring Statement or Autumn Budget last October, and are concerned about how they will affect your financial plan, why not get in touch and speak to one of our expert advisers.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The Financial Conduct Authority (FCA) does not regulate tax advice.

Increasing reliance on the Bank of Mum and Dad

The financial support provided by parents and grandparents has long played a role in family life, but in recent years, it has become a defining force in the broader economy. Dubbed the ‘Bank of Mum and Dad’, this intergenerational flow of wealth is increasingly crucial in helping younger people buy their first homes, fund their education, and establish financial security.

Arrange your free initial consultation

As house prices have surged far beyond wage growth, saving for a deposit has become an uphill battle for many. The average first-time buyer in the UK now needs around £60,000 for a deposit, a sum that would take years to accumulate without external support. Faced with this reality, nearly half of young homebuyers now rely on financial help from family to get onto the property ladder. This trend is even more pronounced in high-cost areas such as London and the South East, where deposits often exceed £100,000. Without parental contributions, home ownership is increasingly out of reach for those without inherited wealth.

A similar pattern is evident in higher education, where rising tuition fees and the high cost of living mean many students graduate with substantial debt. While some rely on student loans, others benefit from parents who cover their fees or living expenses outright. This financial head start can have long-term advantages, allowing some graduates to begin their careers unburdened by debt, while others face years of repayments that delay their ability to save, invest, or buy property.

What does this mean for society?

Beyond individual families, the ‘Bank of Mum and Dad’ has wider economic implications. As wealth is increasingly passed down through gifting, it alters patterns of financial security and social mobility. Those who receive help from their parents enjoy an advantage not only in property ownership but in long-term financial stability, while those without such support find it harder to build wealth.

Research from the Institute for Fiscal Studies confirms that parental earnings are now a stronger predictor of young people’s future income than in previous generations, reinforcing economic divides.

The 7-year rule in inheritance tax

For wealthier families, gifting money to children can also serve a strategic purpose. Under current UK tax laws, financial gifts made more than seven years before the giver’s death typically fall outside of inheritance tax calculations. This means that parents and grandparents who transfer wealth earlier can help reduce the potential tax burden on their estate while providing meaningful support at a time when it is most needed. Given that inheritance tax is charged at 40% on estates above the £325,000 threshold known as the nil rate band (or £500,000 when passing a main residence to a direct descendant, known as the residence nil rate band), careful legacy planning can result in substantial savings.

However, parental generosity is not without its risks. As life expectancy increases and retirement lasts longer, many parents must balance their desire to support their children with their own financial security. Rising care costs and later-life expenses mean that some retirees could deplete their savings too quickly, potentially leaving them reliant on state support or requiring assistance from their own children in later years. A survey by Aegon suggests that over half of UK adults anticipate financially supporting their parents as they age, illustrating how wealth flows between generations in complex and often unpredictable ways.

The future of the ‘Bank of Mum and Dad’

Despite concerns about retirement preparedness, the influence of the ‘Bank of Mum and Dad’ is unlikely to diminish soon. Housebuilding targets remain unmet, real wages have not kept pace with property prices, and the need for financial support among younger generations shows no signs of easing. As a result, families will continue to navigate the challenges of intergenerational wealth transfers, seeking to strike a balance between supporting their children and securing their own financial futures.

For those considering passing on wealth, early planning is key. Seeking professional financial advice can help families structure gifts and inheritance in the most tax-efficient way, ensuring that wealth is preserved and maximised for future generations. As economic trends continue to shift, the role of the ‘Bank of Mum and Dad’ is, for the near future at least, here to stay.

If you’re looking for advice on the best way to support your loved ones, why not get in touch for a free initial consultation to see how we can help.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The Financial Conduct Authority (FCA) does not regulate cash flow planning, estate planning, tax or trust advice.

Reeves' silent squeeze on the middle class

The quiet squeeze on middle-class workers has pushed the number of higher-rate taxpayers past five million for the first time. Official figures show that an additional 680,000 people have been pulled into the 40 percent tax bracket compared to the previous tax year.

This milestone comes amid concerns that Rachel Reeves may extend the ongoing freeze on personal allowances and tax thresholds in her upcoming mini-Budget, despite pledging not to introduce further tax increases.

Many have called out this move as yet another example of ‘stealth tax’ - or to give it the formal name, ‘fiscal drag’.

The future of the freeze

The latest data for 2022/23 is just the beginning, with projections suggesting the total number of higher-rate taxpayers could climb to nine million by 2028, potentially reaching ten million by the end of the decade.

Income tax thresholds were originally frozen in 2021 by then-Chancellor Rishi Sunak to help repair public finances following the Covid-19 pandemic.

While the policy was initially set to last until 2026, Jeremy Hunt later extended it to 2028.

Normally, tax thresholds rise in line with inflation. However, when they remain fixed, rising salaries push more people into higher tax brackets—the phenomenon known as fiscal drag.

To make matters worse, those pulled into the 40% tax bracket are at risk of falling into the 60% tax trap.

What is the ‘60% tax trap’?

Since 2010, those earning more than £100,000 a year have had their personal allowance tapered away until it is completely eliminated for earnings over £125,124.

The ‘60% tax trap’ refers to the income band of £100,000 to £125,000 between which earners in England and Wales will effectively experience a 60% tax rate on their income. This is because for every £2 you earn over £100,000 each year, you lose £1 worth of your £12,570 tax-free personal allowance. Your tax rate only returns to the normal amount of 40% after the entirety of your personal allowance for that year has been deducted, which is at just over £125,000.

For example, an £100,000 earner who receives a bonus of £1000 will only receive £400 of his bonus. This works out as follows:

He immediately loses £400 to the standard 40% tax, leaving him £600.

As he loses £1 for every £2 earned over £100,000, his £1000 bonus translates to £500 deducted from his original tax-free personal allowance. This deduction of £500 is then retroactively taxed at his current standard rate of 40%, meaning he pays another £200.

After paying the original tax of £400 and then the subsequent tax of £200, he is left with only £400 of his original £1000 bonus, meaning he has effectively experienced a 60% tax rate.

How can I avoid falling into the tax trap?

Fortunately, the solution is fairly straightforward. By choosing to make pension contributions on any excess income you earn over £100,000, you can effectively prevent your taxable income from going above the £100,000 threshold and into the 60% tax trap.

Thanks to the Government ‘bonus’ that is paid into your pension whenever you make a contribution, by opting to pay excess income into your pension, you not only save your excess from being taxed 60%, but you also gain a little more than you put in.

HMRC does not consider the excess that you put into your pension as part of your taxable income and therefore will adjust your income back down to £100,000, saving you from the 60% tax trap while also paying you a little extra for putting some pension savings away. It’s a win-win for any serious saver.

If you want to find out more, why not give us a call on 0333 323 9065 or book a free non-committal initial consultation with one of our chartered advisers to find out how can help.

Arrange a free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The Financial Conduct Authority (FCA) does not regulate cash flow planning or tax advice.

How equity release can help with a divorce settlement

Sadly, divorce can happen at any age and although encouragingly divorce is on the decline for most, although divorces among the over 60s doubled between 1993 and 2019 according to figures from the Office for National Statistics (ONS).

Clients that I speak to going through a divorce typically prefer a clean break and are considering their future living arrangements.

It is often the case that the marital home is by far the largest asset in any divorce financial settlement. It could be that the couple will decide to sell the property and split the proceeds and purchase their own properties. More often than not however, I find that one party wishes to remain in the marital home if this is possible.

Can I use equity release to buy out my partner?

Releasing some equity from the marital home through an equity release arrangement can enable one of the divorcing party to continue living in the marital home and become the sole owner of the property, providing funds for the other party to pay towards or purchase outright a property for them to live in.

The moving party could also take out an equity release arrangement if needed, to bridge any shortfall between the monies released to them from the marital home to pay towards their own property and the purchase price of their new home. This enables both parties to maintain their status as homeowners following divorce.

The most popular type of equity release arrangement is a Lifetime Mortgage.

What is a Lifetime Mortgage?

A Lifetime Mortgage, as the name suggests, is a mortgage that is taken out over your lifetime. It does not need to be repaid to the lender until either the death of the homeowner or if the homeowner were to move permanently into care when the property would typically be sold.

The youngest age a homeowner can take out a Lifetime Mortgage is aged 55.

Lifetime Mortgages have fixed interest rates, which are fixed for the home-owners lifetime from outset.

There is no requirement to service the interest and make any capital repayments of the Lifetime Mortgage during your lifetime, although homeowners can do so if they wish and if it is affordable. Therefore, taking out of a Lifetime Mortgage need not negatively impact your cash flow at all.

There are no affordability checks undertaken by the lender when taking out a Lifetime Mortgage. But the taking out of a Lifetime Mortgage could impact means-tested benefits being received, so these do need to be taken into consideration.

A Lifetime Mortgage is portable so if the divorcing parties who take one out decide to move in the future, they can transfer the borrowings onto their new property, subject to the new property being of sufficient value to support the borrowings and it meets the lender’s lending criteria.

Lifetime Mortgages nowadays have a lot more flexible features than in years gone by, when equity release received a lot of bad press. An additional attractive feature is the No Negative Equity Guarantee. This guarantee means that homeowners or their estates will never owe the lender more than the property is worth when it is sold. Typically, there will be equity remaining in the property as the homeowners will continue to own 100% of the property so will benefit from any increases in its value.

It should also be considered if the homeowners qualify for a more conventional residential mortgage if affordable.

How a Lifetime Mortgage works in practice

I think it is always good to reference an actual client situation where a Lifetime Mortgage was used to achieve a clean break in a divorce. I was asked to consider the financial position of a very nice gentleman, aged 74, whose marriage had irretrievably broken down. The main asset of his marriage was the property worth £800,000, which was unencumbered.

His main objectives consisted of the following:

- Needed to fund a lump sum of £375,000 to pay his soon-to-be ex-wife as part of a divorce settlement agreed at a fixed for life interest rate.

- Wanted to preserve as much of his liquid capital as possible, but for this to be balanced against the interest rates applicable for a Lifetime Mortgage, which are higher for higher amounts of equity released.

- No plans to move but may look to downsize in around 5+ years.

- Wanted to continue to own his property in full and benefit from any increases in the value of his property.

- Wanted to have the ability to transfer the borrowings under the Lifetime Mortgage to a new property, if and when he moves in the future, and repay any balance the lender requires at the time, without any early repayment charges being imposed.

- Wanted to have the ability to make repayments of up to 10% of the amount borrowed through a Lifetime Mortgage when affordable, which most lenders allow without any early repayment charges being imposed.

We were able to meet all of the gentleman’s above objectives by taking out a suitable Lifetime Mortgage. His soon-to-be ex-wife was herself able to use the lump sum received to pay towards a property for her to live in.

The gentleman was relieved to be able to continue living in the property he loved and have sufficient cash flow coming in to provide him with a comfortable lifestyle as there isn’t the requirement to service the interest or repay any capital for the Lifetime Mortgage over his lifetime.

He was a chap who told me he swims a mile regularly a few times a week. He and I have that in common though not sure I will be able to do that at age 74!

Can we help you?

If you need help in exploring if equity release can facilitate a divorce settlement, please do get in touch. As independent financial advisers, we will consider your whole financial situation to ensure you get the right outcomes. Why not give us a call for a free initial discussion today and see how we can help you.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

Please note this is a lifetime mortgage to understand the features and risks, ask for a personalised illustration.

10 Things to do before the end of the Tax Year

As the end of the tax year approaches, there is a limited window to take full advantage of available tax breaks, allowances, and financial planning opportunities. Acting now can help ensure you are making the most of your savings and investments.

10 Things to do before the end of the tax year

Arrange a free initial consultation

1. Use your ISA allowance

One of the most valuable allowances to utilise before the end of the tax year is the Individual Savings Account (ISA) allowance. ISAs allow you to save or invest up to £20,000 per year tax-free, and if you do not use your allowance before the tax year ends, you lose it. This means you cannot carry over any unused portion into the next tax year. If you have not yet maximised your ISA contributions, now is a good time to do so.

2. Transfer your ISA?

While making use of your unused ISA allowance you could also consider whether your existing ISA arrangements continue to be appropriate. Transferring funds from a Cash ISA to a Stocks and Shares ISA does not count towards your annual ISA allowance. You may want to consider transferring your Cash ISAs to a Stocks and Shares ISA to potentially achieve better long-term growth. However, this depends on your personal financial goals and risk appetite. It’s important to fully understand the risks involved and seek independent financial advice if necessary before making any decisions.

3. Pension contributions

Pension contributions are another key area to review before the tax year ends. Making the most of pension tax relief can significantly enhance your retirement savings. Contributions to pensions receive tax relief at your marginal rate, meaning higher-rate and additional-rate taxpayers receive substantial benefits. If you have not yet used your full annual allowance of £60,000, you may also be able to carry forward unused allowances from the past three years – subject to your relevant earnings in those years and provided you were a member of a pension scheme during that time. Checking your contributions now and making any additional payments before the deadline can help you maximise the tax advantages available.

4. Reduce your Capital Gains Tax

Capital Gains Tax (CGT) planning is also worth considering. Each individual has an annual CGT allowance, which for the 2024/25 tax year stands at £3,000. If you are planning to sell assets such as shares, property, or other investments, you may want to do so before the end of the tax year to take advantage of this exemption. Spreading the sale of assets over multiple tax years or transferring assets to a spouse or civil partner can also help reduce overall tax liability, provided it is a genuine gift. Reviewing your investment portfolio now could identify opportunities to realise gains while minimising tax exposure.

5. Charitable giving

Charitable giving is another area where tax efficiency can be maximised. Donations made through Gift Aid allow charities to reclaim basic-rate tax on your contributions, and higher-rate taxpayers can claim additional relief through their tax return. If you are considering making charitable donations, doing so before the tax year ends ensures that any applicable tax relief can be claimed in this tax period. This not only benefits the causes you support but also provides an opportunity to reduce your tax bill.

6. Business owners & Self-employed

For business owners and self-employed individuals, it is important to review income and expenses before the tax year closes. Ensuring all allowable expenses are claimed can reduce taxable profits and overall tax liability. Making pension contributions through a business can also provide tax-efficient savings while reducing the company’s taxable income. If your business has made a profit, considering investments in capital expenditure before the end of the tax year may allow you to take advantage of available tax reliefs. However, accountancy advice should be sought before going down this route.

7. Use personal allowances

Using personal allowances efficiently is another important step before the tax year ends. Every individual has a tax-free personal allowance, and for those who are married or in a civil partnership, the Marriage Allowance or transferring assets between spouses can help optimise tax efficiency. Reviewing how income and assets are structured within a household can help ensure that all available allowances are fully utilised.

8. Junior ISA allowance

If you have children, making use of the Junior ISA allowance is another way to maximise tax-efficient savings. You can contribute up to £9,000 per tax year into a Junior ISA, helping to build a long-term financial foundation for your child while benefiting from tax-free growth. Those considering financial gifts to children or grandchildren should also be aware of the annual gifting allowance of £3,000, which allows individuals to make tax-free gifts without being subject to inheritance tax.

9. Make the most of all allowances & reliefs

With the end of the tax year fast approaching, taking action now can ensure that you are making the most of the allowances and reliefs available to you. The tax system is complex, and missing out on valuable opportunities can mean paying more tax than necessary. A financial adviser can help navigate the various options, ensuring you make informed decisions tailored to your financial situation and long-term goals. Seeking professional advice can also provide peace of mind, ensuring you are fully compliant with tax regulations while optimising your financial position.

10. Take professional financial advice

Time is running out, but there is still an opportunity to make strategic financial decisions before the tax year ends. Reviewing your savings, pensions, investments, and allowances now will put you in a stronger position for the future. If you are unsure about the best course of action, consulting a financial expert can help you take full advantage of the tax-saving opportunities available before it is too late.

Arrange a free initial consultation

The Financial Conduct Authority (FCA) does not regulate tax advice or estate planning.

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

Investment returns are not guaranteed, and you may get back less than you originally invested.

UK Population Boom: The Impact on Retirement

The latest figures from The Office for National Statistics (ONS) revealed Britain’s population could skyrocket in the next few years.

The figures, based on current and past trends, were used by the ONS for population projections. Over the decade from 2022, net migration is expected to add 4.9 million people to the UK’s population, taking the total from 67.6 million people in mid-2022 to 72.5 million people by mid-2032.

The data, released on Tuesday, assumes net migration will average around 340,000 a year from mid-2028, which is actually lower than current levels. With natural births and deaths currently cancelling each other out in the UK, this population growth will come almost entirely from migration.

Arrange a free initial consultation

James Robards, from the ONS, said: “The UK population is projected to grow by almost five million over the next decade. The driver of this growth is migration, with natural change – the difference between births and deaths – projected to be around zero.”

“Our latest projections also highlight an increasingly ageing population, with the number of people aged over 85 projected to nearly double to 3.3 million by 2047. This is in part because of the ageing of the baby boom generation, as well as general increases in life expectancy.”

An ageing population

As highlighted by Robards, the UK has what’s known as an ‘ageing population’, where a country has the number of older, often retired people, increasing relative to the number of younger, often working age people. The further this ratio increases, the greater the strain on the healthcare system and Government services like the state pension as the working population struggle to support the expanding older age groups.

While the increase in working age migrant workers will take some pressure off in the short-term, the gap continues to grow. That is why it is essential to not rely solely on your state pension, especially with the age of retirement continually being pushed higher in an attempt to take pressure off Government services.

Below are some of the different ‘levels’ of retirement, highlighting just how important it is to have a strong private pension if you want the maximum freedom after you retire.

What is a ‘good’ retirement?

In the UK, retirement living standards are commonly categorised into three levels: Minimum, Moderate, and Comfortable. These benchmarks, developed by the Pensions and Lifetime Savings Association (PLSA), help individuals plan for retirement by outlining the annual income required for each lifestyle.

-

Minimum Retirement Living Standard

This level covers essential needs, including housing, food, and utilities, with some allowance for social activities. As of 2024, a single person requires an annual income of £14,400 to achieve this standard. The full new State Pension provides £11,502 per year, leaving a shortfall of £2,898 to be covered by private pensions or other savings.

-

Moderate Retirement Living Standard

This standard allows for a more comfortable lifestyle, including a car, occasional holidays, and increased spending on leisure activities. A single person needs an annual income of £31,300 to maintain this lifestyle. After accounting for the full State Pension of £11,502, an additional £19,798 per year is needed from private pensions or savings.

-

Comfortable Retirement Living Standard

This level supports a more affluent lifestyle, with extended travel, higher quality food and clothing, and increased spending on hobbies. A single person requires an annual income of £43,300 for this standard. With the State Pension contributing £11,502, the remaining £31,798 must come from private pensions or other savings.

It's important to note that these figures are based on the PLSA's Retirement Living Standards and are subject to change with inflation and personal circumstances. Additionally, the actual amount received from the State Pension depends on an individual's National Insurance contributions. Therefore, it's advisable to regularly review your retirement plans and consult with a financial adviser to ensure your savings align with your desired retirement lifestyle.

If you want to find out more about how you can navigate your retirement, why not give us a call on 0333 323 9065 or book a free non-committal initial consultation with one of our chartered advisers to find out how we might be able to help you.

Arrange a free initial consultation

The Financial Conduct Authority (FCA) does not regulate tax and cash flow planning.

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

Inflation slows, savings rise – a win for savers?

2024 ended with inflation at slightly higher than the Government’s target of 2%, although a little lower than expected, the latest figures from the Office for National Statistics (ONS) show.

In the 12 months to December 2024, the headline inflation rate as measured by the Consumer Prices Index (CPI) was 2.5% - slightly lower than 2.6% in November – and below the forecast which was for the rate to remain unchanged.

Possibly more importantly though, core inflation fell to 3.2% from 3.5% in December, and services inflation fell too, from 5% in November to 4.4% in December. These latter inflation measures are reviewed closely by the Bank of England when they consider interest rate decisions. And what these figures mean is that a base rate cut could well be on the cards at the next Monetary Policy Committee (MPC) base rate meeting on 6th February 2025.

Arrange a free initial consultation

Michael Saunders, a former member of the Bank of England's MPC, told the BBC, "if it stays like this, we will be "en route" to slightly more interest rate cuts"

The key drivers of the unexpected fall in inflation in December were the slowing price rises of restaurants and hotels. The ONS reported “The annual inflation rate for restaurants and hotels was 3.4% in December 2024. This is down from 4.0% in November and is the lowest annual rate since July 2021. On a monthly basis, prices fell by 0.1%, compared with a rise of 0.5% a year ago.”

However, Rob Wood, the Chief UK Economist at Pantheon Macroeconomics said that “Both will reverse in January, so the dovish news today [15/01/2025] is a temporary reprieve.” He added that “inflation is still heading above 3% in April.”

So, the Bank of England policy makers are likely to remain cautious and it’ll be interesting to see what the January inflation figures look like, which will be announced ahead of the next MPC meeting.

We‘ll have to wait and see, but the good news for savers is that while we do so, there are other economic forces at play, that are causing fixed term bond and ISA rates to increase!

It’s been widely reported that UK gilt yields have been soaring, and this is a concern as the Government has to offer higher interest rates to attract investors to new bonds.

Governments generally borrow money by selling bonds (known as gilts in the UK) to big investors, such as pension funds. The higher yields increase the cost of borrowing, potentially straining public finances, especially if the government has a large debt.

But on the plus side for savers, rising gilt yields is linked to rising fixed term savings rates, and that is what we have seen recently, especially on the best rates for longer term bonds and ISAs. Increasing savings rates and slowing inflation is a great combination for savers and means that there are many accounts available that are paying an interest rate that is higher than the current level of inflation, even if you now pay tax on your savings interest.

Take advantage while you can

At the beginning of this year, the top 5-year bond was paying 4.50%, but at the time of writing, this has leapt to 4.78% - and even more interestingly, this rate is higher than the top 1-year bond, which is currently 4.77%.

It’s been quite some time since you could earn more when locking your cash up for longer – so it’s a good opportunity to get a top rate that should provide an inflation beating return over the next few years, even though interest rates are expected to continue to fall, although more slowly and to less of a degree than previously expected.

Rates on the top fixed term cash ISAs have increased too this year, but the longer term are still paying less than the short-term accounts. The average of the top five 1-year ISAs is now 4.53% up from 4.50% at the beginning of the month, although the best rate is only 0.01% higher at 4.54%, up from 4.53% on 2nd January. The top 5-year ISA is now paying 4.21%, up from 4.18%. Regardless of how small, increases are welcome, nevertheless.

But things may already be settling down.

The yield on the 10-year gilt - the interest rate at which the government pays back a decade-long loan to investors – dropped to 4.72% on Wednesday, having risen to nearly 4.9% on Monday, its highest level for 17 years.

Meanwhile, by Wednesday, the 30-year gilt yield stood at 5.30%, below Monday's peak of 5.46%.*

As a result, if you are thinking of locking up some of your cash, you might want to strike while the iron is hot, as we don’t know when things may reverse.

Take a look at our Best Buy tables to find the right account to pay you the most interest.

Check if your savings are keeping ahead of inflation with our inflation calculator below:

If you have £100,000 or more in pensions, savings and investments and would like to receive a free initial cash flow forecast, up to the value of £500, please arrange a chat here.

Arrange a free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The Financial Conduct Authority (FCA) does not regulate cash advice.

The accounts and rates mentioned in this article are accurate and correct as of 16/01/2025.

* Source: FT & MarketWatch

The Great Wealth Transfer: an opportunity for HMRC

The United Kingdom is set to witness an unprecedented shift in financial assets and wealth in what is being labelled as the “great wealth transfer.” ‘Baby boomers’ (born between 1945-1965), who collectively hold a significant portion of the nation's wealth, are poised to pass down £5.5 trillion over the next two decades.

Generational Windfall: The Great Wealth Transfer

Whilst the expedited timescale of the passing down of capital and assets represents an extraordinary opportunity for younger generations to accumulate wealth, there is also the potential for significant financial challenges for families across the UK set to inherit these estates. These could range from stress and anxiety of receiving large sums of money someone has not managed before, through to fast changing tax policy leaving estates previously unaffected by Inheritance Tax (IHT), suddenly facing a large liability.

Arrange your free initial consultation

Labour’s Autumn Budget and Its Impact

Labour’s recent Autumn Budget has added a layer of urgency to IHT planning. Among the numerous changes announced, the most significant include extending the freeze on IHT thresholds until 2030, bringing inherited pensions into the taxable estate from April 2027, and diminishing Agricultural Property Relief (APR) and Business Property Relief (BPR) changes from April 2026, which will mean that agricultural assets over £1,000,000 will face a 20% tax bill, pushing many into selling land off.

The IHT threshold freeze keeps the nil-rate band at £325,000, a figure unchanged since 2009, despite the ever-present effects of inflation reducing the real value of this over the years, historically soaring house prices , and now the inclusion of pensions into the estate. This could be seen to be yet another form of ‘fiscal drag’ or stealth tax, pinching individuals and families with the country paying the highest levels of tax in 70 years, and HMRC collecting 37% of the UK’s total GDP in tax receipts.

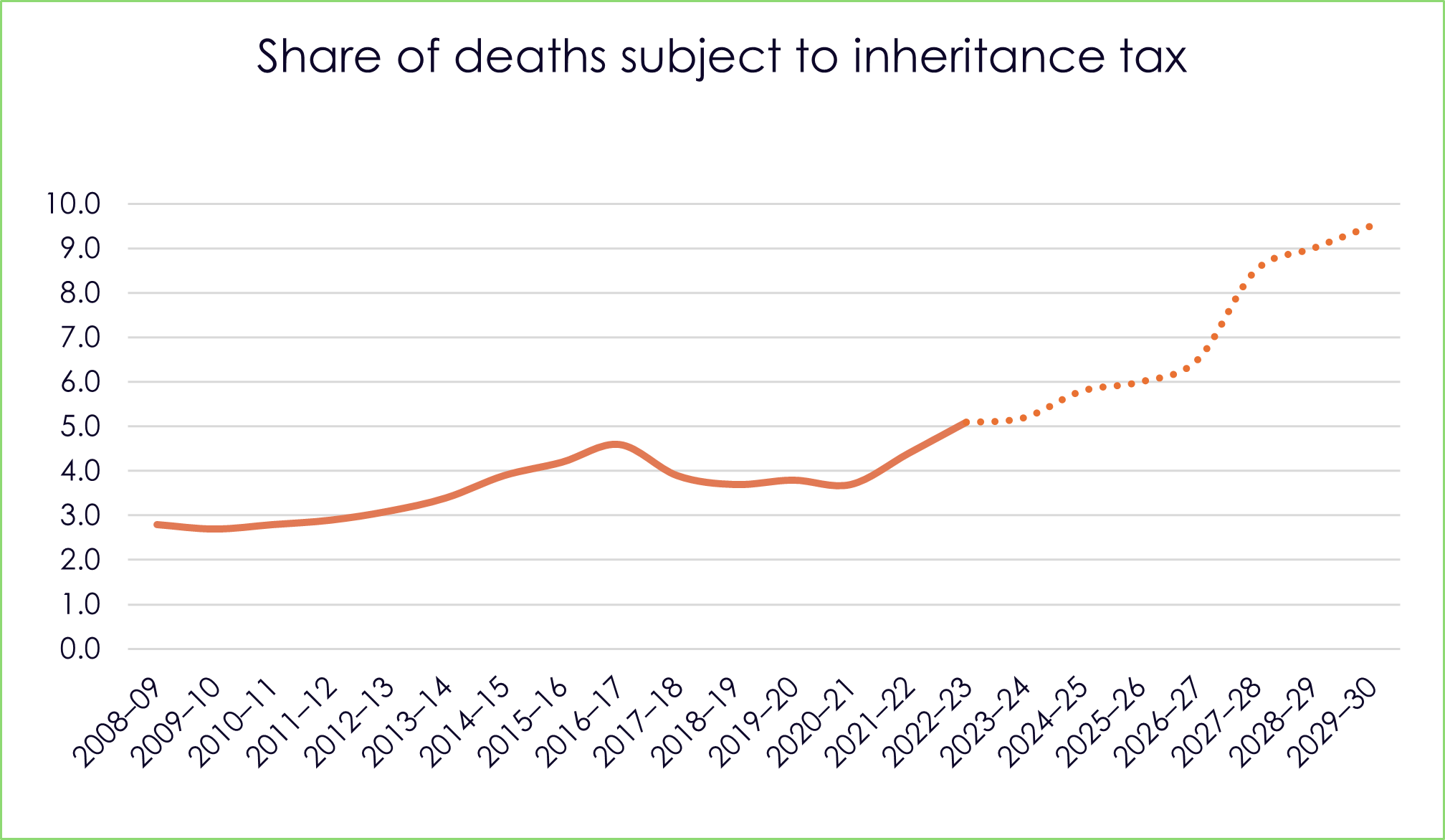

Figure 1 - Share of deaths subject to Inheritance tax, Source: IFS Report R235, 2022

For many families, this means that wealth once thought safe from IHT may now face the 40% levy. Rising property values, especially in the South East, push even modest estates above the threshold, leaving fewer households exempt. With Labour’s changes expected to swell government IHT receipts even further—already up 11% year-on-year. Between 2024-25 and 2028-29, the OBR now estimates the Treasury will collect more than £50bn in inheritance tax alone, a 19% increase of more than £8bn compared to the forecast made following ex-chancellor Jeremy Hunt’s Spring Budget in March 2024. Navigating this shifting tax landscape will be critical for those looking to preserve their legacy and look after their children once they are gone. When an estate is liable to IHT, the average amount paid stood at £215,000 in the Tax Year 2021-22, and the future forecasts only point in one direction, which is up.

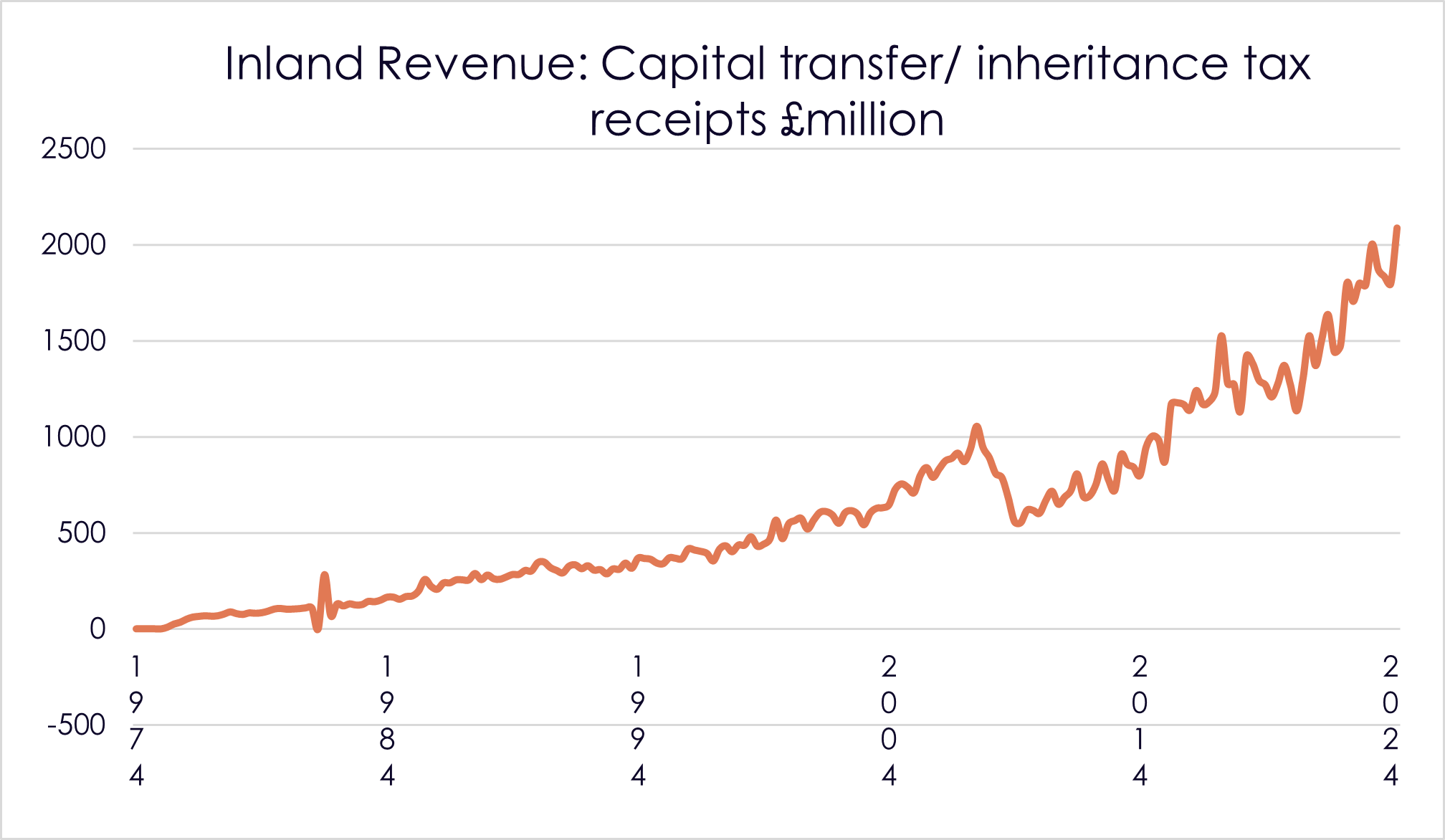

Figure 2 - Inland Revenue: Capital transfer/ Inheritance tax receipts £million, Source: Office for National Statistics, 2024

Opportunities and Challenges of the Wealth Transfer

This generational windfall presents a double-edged sword. On one hand, it could offer younger generations the financial support needed to tackle rising living costs, fund housing purchases, or build a secure retirement. On the other, without professional advice, much of this wealth could erode before it can deliver meaningful benefits. Giving too much too soon could leave aging parents without the resources to fund long-term care, and poorly structured plans can further lead to significant tax bills, family disputes, or mismanaged assets . Due to the complexities of managing large estates and recent changes, it is more essential than ever before for families to plan proactively.

Preparing for the Transfer

For those expecting to receive or pass on wealth, there are several practical steps to mitigate tax exposure and ensure financial security:

- Gifting Strategically: Taking advantage of the £3,000 annual gifting allowance or larger tax-free gifts during life can reduce the taxable value of an estate.

- 7-year rule: If you die within 7 years of gifting an asset to an individual, the 7-year gift rule in inheritance tax means that the beneficiary may be required to pay IHT. If you survive 7 years, then the gift may be IHT free.

- Consider Life Assurance: Whole of life cover is not designed to stop IHT outright, but rather to assist beneficiaries of the estate to meet the liability in the form of a lump sum on the death of the policyholder. It is crucial to get professional advice on this to help calculate the size of the estate, the amount of tax that could be due, and therefore size of the lump sum required on death and the cost of premiums this could result in.

- Cash flow planning: helps illustrate information regarding how much of an estate someone can gift away without causing unnecessary detriment to their own lifestyle and ability to fund potential long-term care should it be needed.

- Setting Up Trusts: Trusts provide a way to transfer wealth while maintaining control and reducing tax liabilities.

- Seeking Professional Advice: A financial adviser can help families structure their estates to align with personal goals and minimise tax exposure.

Why Act Now?

Labour’s Budget changes demonstrate the rules governing inheritance and taxation are in constant flux. Early planning is critical to ensure that your hard-earned wealth benefits those you care about most, rather than being diminished by unnecessary tax bills. Whether you are planning to pass on your estate or a beneficiary preparing for an inheritance, acting today could hopefully safeguard your family's financial legacy for generations to come.

If you’re concerned about IHT on your estate and want to learn, why not get in touch for a free initial consultation.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The Financial Conduct Authority (FCA) does not regulate cash flow planning, estate planning, tax, or trust advice.

Tax return deadline fast approaching

Recent data from HM Revenue & Customs (HMRC) revealed 5.4 million taxpayers are still racing against the clock to file their tax returns as the 31 January deadline looms. Missing the deadline could result in fines, beginning at £100 and escalating into legal proceedings. This is in addition to the eye-watering 7.25% interest charge on any late tax payments.

HMRC’s figures also revealed nearly 25,000 people began the new year by filing their tax returns on 1 January, while 38,260 taxpayers submitted their self-assessment submissions on New Year's Eve.

Myrtle Lloyd, HMRC's director general for customer services, urged prompt action: "We know completing your tax return isn’t the most exciting item on your new year to-do list, but it’s important to file and pay on time to avoid penalties or being charged interest.

"The quickest and easiest way to complete your tax return and pay any tax owed is to use HMRC’s online services – go to gov.uk and search ‘self-assessment’ to get started now."

What is Self-Assessment?

Self-Assessment is the process you go through each year where you complete a tax return and declare your income, capital gains and any other income during that tax year to HMRC, outside of income tax that is normally deducted from your wage or pension.

Although most commonly done by those who are self-employed, anyone who has other income outside what is normally deducted from your wages and pension, need to complete a self-assessment form – which can be paper based or digital.

Irrespective of employment status, if you have received any untaxed income before the deadline of that tax year, you may need to complete a tax return. Even if that income comes from Ebay, Etsy or similar enterprises.

Who needs to submit a tax return?

You may need to submit a tax return if ANY of the following applied to you in the 2023/2024 tax year (6 April 2023 to 5 April 2024):

- You were self-employed and your income was more than £1,000

If you earned £1,000 or less, you may still need to do a self-assessment if you want to pay 'class 2' National Insurance contributions voluntarily to protect your entitlement to the state pension and certain benefits. - You earned more than £150,000 in taxable income. This threshold was £100,000 for the 2022/23 tax year but it's been increased. If your income is between £100,000 and £150,000 and that was the only reason you had to complete a tax return for 2022/23, you should have got a letter from HRMC telling you that you don't need to do one for 2023/24. If in doubt, contact HMRC directly to check.

- You claimed Child Benefit when you or your partner earned more than £50,000 a year

This is known as the high income Child Benefit charge. The income threshold has now been raised to £60,000 – but the older threshold still applies for the 2023/24 tax year. - You earned £10,000 or more before tax from savings interest, investments, shares or dividends

Between April 2022 and April 2024, the Bank of England base rate rose from 0.75% to 5.25%. As a result, savings rates (and therefore interest payments) went up across the board – so, even if you had the same amount saved, you're more likely to have hit the threshold in 2023/24 compared to the year before.

It should be noted that if you earn more than £1,000 but less than £10,000 on savings, then HMRC will automatically amend your tax code so you don’t need to fill in a form.

Other scenarios to consider

- You earned money from renting out property such as a buy-to-let property or portfolio (or from other untaxed income, such as tips or commission).

- You earned income from abroad.

- You need to pay Capital Gains Tax.

- You received income from a trust.

- You filed a self-assessment tax return for the 2022/23 tax year (unless you've already told HMRC you no longer need to or HMRC has told you not to).

When you need to submit a tax return

This tax year ends on 5 April 2025 and all tax returns for this year will need to be completed by 31st January 2026.

Most importantly, you must tell HMRC by 5 October if you need to complete a tax return and have not sent one before. Then there are different deadlines for different types of tax returns.

If you’re doing a paper tax return, you must submit it by midnight 31 October 2025. HMRC must receive a paper tax return by 31 January if you’re a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

If you’re doing an online tax return, you must submit it by midnight 31 January 2026, and if you want HMRC to automatically collect the tax you owe from your wages and pension, then you need to submit your online tax return by 30 December.

In all cases you need to pay the tax you owe by midnight 31 January 2026.

If you’re interested in finding out more about how we can help you build a tax efficient portfolio, making best use of allowances available to you whilst ensuring your money is working hard, Why not give us a call on 0333 323 9065 or book a free non-committal initial consultation with a member of our team.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The Financial Conduct Authority (FCA) does not regulate tax or trust advice.

More being caught in 60% tax trap

A freedom of information request by the Financial Times to HM Revenue & Customs (HMRC) revealed that the number of individuals caught in the 60% tax trap had risen by 45% in just two years.

The figures showed that in the 2021-22 tax year, a total of 436,000 taxpayers fell into the 60% tax bracket, while in the 2023-24 tax year, this number had risen to 634,000, an increase of 45%.

Unfortunately, this trap is only becoming more widespread with time as wages grow but personal allowance thresholds remain frozen.

A major driver of this is the income tax bands have been frozen until 2028, and this includes the tax-free personal allowance threshold, which has been frozen at £12,570 since April 2021. With Chancellor Rachel Reeves announcing in her Autumn Budget that the freeze would be maintained until April 2028, the number of taxpayers caught in the tax trap will likely only increase further as wages creep to keep up with inflation and the rising cost of living but thresholds remain the same.

Check out our article to find out how you can take steps to avoid these higher rate tax traps.

What is the ‘60% tax trap’?

The ‘60% tax trap’ refers to the income band of £100,000 to £125,140, between which earners will effectively experience a 60% tax rate on their income. This is because for every £2 you earn over £100,000 each year you lose £1 worth of your £12,570 tax-free personal allowance. Your tax rate only reduces to the additional rate of 45% after the entirety of your personal allowance for that year has been eroded, i.e. on income above £125,140.

For example, someone earning £100,000 who receives a bonus of £1000 will only receive £400 of his bonus. This works out as follows:

He immediately loses £400 to the standard 40% higher rate tax, leaving him £600.

As he loses £1 for every £2 earned over £100,000, his £1000 bonus translates to £500 deducted from his original tax-free personal allowance. This deduction of £500 is then retroactively taxed at his current standard rate of 40%, meaning he pays another £200.

After paying the original tax of £400 and then the subsequent tax of £200, he is left with only £400 of his original £1000 bonus, meaning he has effectively experienced a 60% tax rate.

If you’re concerned you may fall into the 60% tax trap, why not get in touch and see how we can help. Controlling your income with your pension to get the best outcome for your personal financial situation is complex and time-consuming. Many people find that getting the help of a financial adviser will seriously improve their financial outcome and wellbeing.

If you want to find out more, why not give us a call on 0333 323 9065 or book a free non-committal initial consultation with one of our chartered financial advisers to find out how we can help.

Arrange your free initial consultation

The Financial Conduct Authority (FCA) does not regulate cash flow planning, estate planning, tax or trust advice.

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.