Don’t let redundancy derail your future

In anticipation of the first Labour budget in 14 years and repeated warnings from the Prime Minister that it would be ‘painful’, many companies delayed financial decisions in an attempt to mitigate any potential fallout ahead of the day. This included hiring and investment freezes amid speculation of tax rises. These came to fruition in the form of an Employers National Insurance increase from 13.8% to 15% across the board and reducing the threshold at which companies pay it from £9,100 to £5,000 (excluding smaller companies that are eligible for the employment allowance).

Arrange your free initial consultation

The consequences of this are yet to be fully realised. However, following 30th October there were concerns raised by the British Retail Consortium, which represents the likes of Amazon and Tesco, that job losses will be ‘inevitable’, a rhetoric also echoed by many in the hospitality industry, dealing a further blow after several difficult years. This follows a string of high profile and large-scale redundancies throughout 2024 from firms such as Ford, Dyson, and John Lewis cutting a total of 5,600 jobs in the last six months alone. These recent and ongoing events in the political and economic spheres should all serve as a reminder of the often-overlooked fragility of employment and the importance of having a plan in place, as this can provide peace of mind and some breathing room if you were to be made unemployed.

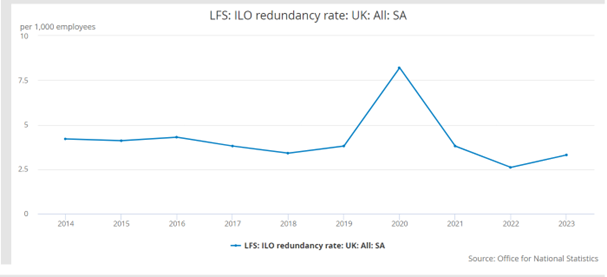

Figure 1 - UK Redundancy Rate, Source: LFS: ILO redundancy rate: UK, 2024

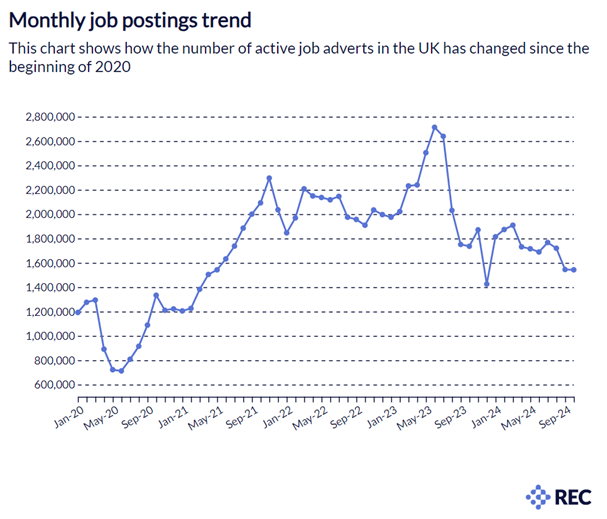

Figure 2 - Monthly job posting trends, Source: Labour Market Tracker: The REC, 2024

How to help avoid your financial plan being derailed by redundancy

Cash emergency fund

A part of any financial plan needs to include a substantial emergency cash reserve, to ensure you are not immediately impacted by any shocks such as redundancy. As a general guide, an emergency cash fund would typically be between 3 and 12 months of income. We spend significant time with clients, using cash flow modelling, to provide answers around the size of your cash fund and how to build this buffer.

In turn using cash flow modelling and sticking to a financial plan, built with your adviser, you should have the comfort and reassurance that if a shock such as redundancy was to occur, you have built savings and investments to sustain you during such a period.

When you are made redundant

Although redundancy is a shock to your financial plans and typically seen as a negative, it can also present an opportunity for those approaching retirement. One of the opportunities which may present itself is to make use of your redundancy payment as a contribution into your pension (up to your annual allowance or carry forward allowance). If you are close to retirement, it is an effective way of increasing the value of your pension pot with tax relief, before you potentially look to draw on it, in a tax efficient manner. All linked to your retirement plan.

For those who are younger when they experience redundancy, during the critical ‘accumulation’ stage of the financial plan, redundancy can point to the importance of having a financial plan and initiating these conversations with an adviser. Furthermore, typically those who are made redundant and are able to find new employment fairly quickly, there is an opportunity to implement a new refreshed financial plan to protect against any future shocks, which once again can we modelled within cash flow.

Remember, a drop or complete stop in both you and your employer’s pension contributions could seriously affect your financial plans, not least if this also includes a stop on any other benefits you may have received from your employer, such as a company car, phone or health benefits that may need to be replaced.

So, it’s really important you take the opportunity to step back and re-evaluate the financial plans you have for the future, especially if you don’t get back into employment fairly quickly.

Redundancy payment

A redundancy payment is treated as taxable income over the £30,000 tax free allowance. This payment therefore provides an amount to protect the employee from any initial cashflow problems. In terms of options for this payment there are many. As mentioned above you could contribute to your pension, which is especially tax efficient for those approaching retirement at the point of redundancy. However, there are other options as well. For instance:

- Make an overpayment/pay off a mortgage; this is a potential option to make your wider situation more secure and provide some additional comfort in a time of uncertainty.

- Hold the payment in cash accounts and draw on the money where appropriate to ensure you remain stable; this means ensuring your cash is earning the best interest is critical, please see the Best Buy Tables

The benefit of receiving advice

Conducted by one of our experienced financial planners, cash flow modelling provides you with clarity on your current financial position and what it might mean for the future.

It simply lays out all of your income and expenditure to map out your financial future. The earlier you seek advice and begin implementing a plan the more robust your situation will be to ride out any financial shocks such as redundancy. Having a clear plan with your finances is proven to be beneficial in the long run, and with our clients at TPO we utilise cash flow modelling to give them the comfort in case of redundancy or any other similar financial shock.

If you’d like to speak to an independent financial adviser about your own personal financial plans, whether you’re concerned about redundancies or not, then why not get in touch. We can map out your financial future so you have the confidence that your wealth will last you for as long as you need it.

Arrange your free initial consultation

The financial conduct authority (FCA) does not regulate cash flow planning.

Investment returns are not guaranteed and you may get back less than you originally invested.

Past performance is not a guide to future returns.