New pension opportunities, but you may need to act fast!

In the 2023 Spring Budget, Chancellor of the Exchequer Jeremy Hunt took many by surprise with his chosen policy changes, particularly in regard to pension allowances. Not only was the Annual Allowance increased from £40,000 to £60,000 and the more restrictive Tapered Annual Allowance increased from £4,000 to £10,000, but it was also announced that the Lifetime Allowance would be abolished.

Consequently, and taking into account a looming election and possible change of government, now could be an opportune time to consider whether you are aiming to maximise your pension contributions prior to the end of the current tax year to take advantage of these tax benefits.

Arrange your free initial consultation

What is the Annual Allowance?

The annual allowance is the maximum amount of pension savings an individual can make each tax year without an annual allowance allowance charge applying.

As noted above, from the start of the current tax year, the annual allowance was increased to £60,000, and you can receive tax relief on your personal contributions up to 100% of your relevant UK earnings (including salary, bonuses, commission).

However, high earners could be subjected to a tapered annual allowance, which gradually reduces their annual allowance to a minimum of £10,000 for those with taxable income over £260,000.

Personal pension contributions are eligible for tax relief at an individual’s marginal rate of income tax. This means that a basic rate taxpayer will receive a 20% uplift on the money they contribute to their pension. A higher or additional rate taxpayer can then also claim an additional 20% or 25% via their self-assessment tax form, resulting in an overall potential tax saving of 40% or 45%!

Employer or Company contributions are also paid gross and can receive corporation tax relief as a business expense.

What is ‘Carry Forward’ and does it apply to me?

Unlike with an ISA, whereby if you do not contribute the full ISA allowance of £20,000 by the 5th of April in a given tax year then this unused allowance is lost forever, this rule does not apply to pensions. The Government introduced the carry forward rules in April 2011, allowing individuals to utilise any unused pension annual allowance from the previous three tax years.

Those with a tapered annual allowance can also still use carry forward if they have any unused annual allowances remaining in previous three tax years.

In order to carry forward any unused annual allowance from these tax years, you must:

- Be a member of a UK-registered pension scheme and had a qualifying pension (this does not include the state pension) since the 2020/21 tax year.

- Have used up your entire annual allowance in the current tax year.

- Have remaining unused annual allowance in previous tax years.

- Have sufficient relevant UK earnings in the current tax year for a personal contribution.

Lifetime Allowance & Transitional Protections

Due to the tax advantages of making pension contributions, the Government previously placed a limit on the amount of pension benefits an individual could accumulate over their lifetime, without incurring a tax charge. This tax charge is known as the Lifetime Allowance (LTA) charge and applied to individuals with pensions valued over £1,073,100.

However, with the UK Government announcing that the LTA charge would be removed from 6 April 2023 and then the LTA abolished from 6 April 2024, this means there is an opportunity for those who are near to or who have exceeded the £1,073,100 threshold to consider recommencing pension contributions.

Historically, the Government has provided individuals with the opportunity to apply to protect their LTA before any changes in legislation. Certain types of transitional protection were introduced with the stipulation that you could no longer make any further pension contributions, but this restriction was then also lifted for those with existing protection before 15 March 2023.

Therefore, this has presented another potential opportunity, as those previously unable to make any contributions due to the risk of losing their protection, may have a significant level of unused annual allowance from previous tax years.

Use it or lose it

With wage growth reaching 7.3% for the period between August to October 2023 (according to the ONS), the tax band freeze means people are technically paying more income tax than ever before. Therefore, it would be prudent to look for ways to maximise the tax-efficient legalisation currently on offer.

Aside from the fact that any unused annual allowance from the 2020/21 tax year will be lost after 5th April 2024, there is no predicting if or when changes will be made again to this legislation. It seems as if the UK population collectively hold their breath at the sign of any Budgets which have seen a vast array of changes to pension rules over the years.

Whilst the most recent changes were positive for pension savers, it is important to consider the implications of the impending election in the next 6-12 months; if there is a change in government then this policy change could be reversed. With that and all the above in mind, it is worth exploring your options and taking appropriate action concerning your carry forward allowance; use it before you lose it!

Pensions can be a complicated and daunting matter to navigate, from obtaining the relevant information from your pension providers to a thorough understanding of ever-changing UK legislation. Therefore, please do reach out to a financial adviser if you would like help making the best use of your savings and pension allowances.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

A pension is a long-term investment. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

The Financial Conduct Authority (FCA) does not regulate tax advice.

The importance of Cash

There’s no getting away from it, costs have risen exponentially. With a growing cost of living crisis throughout the country, the need for cash retention to act as a buffer in these circumstances remains vital for everyone. This increase in costs will likely mean most people will need to try and save money where they can. Nevertheless, while cash is a crucial component of a well-rounded financial strategy, it's essential to strike a balance. Allocating too much cash for an extended period could expose your wealth to inflation risk, where the purchasing power of your money will decrease over time. It is therefore imperative to assess your overall financial goals, time horizon and risk appetite when deciding how much to keep in cash versus how much to invest in other assets.

There are many reasons to hold money in cash, so we look to explore the importance of cash and its inherent benefits within personal finance, whilst also considering the common risks associated with cash investments. Of course, managing your savings is a highly personalised process, and how much you save should reflect your individual circumstances.

Arrange your free initial consultation

Emergency Fund

The term ‘emergency fund’ or ‘buffer’ refers to money set aside for the sole purpose of being used in times of financial distress. The fund provides a financial safety net to cover any unexpected, and typically costly, expenses that may arise such as those following a loss of job or unexpected tax bill. The amount you should target for an emergency fund depends on a number of factors, including your financial situation, expenses, lifestyle, and debts. Typically, consideration may be given between three to six months of normal expenditure in cash, to be drawn from in the event of an emergency. This is considered a prudent financial practice because it helps avoid unnecessary debt and financial stress.

Top Tip: Starting off small is better than not starting at all!

The Stock Market

While investing in the stock market offers great potential opportunities for accumulating wealth and financial growth, it is important to be aware of the fundamental downsides and risks, and striking the right balance between investments and cash has proven particularly relevant over the past few years with investment markets going through a turbulent time.

Although investors are attracted to the idea of growing their wealth through stock market investments, this should always be looked at as a long-term strategy given the risks associated.

Up until November 2021, there were very few options for your lower risk portion of your wealth, as interest rates were extremely low. However, since the recent interest rate hikes many investors are turning their attention towards setting aside some cash into savings account and are benefiting from some of the highest returns in almost two decades. Unsurprisingly, the last few years have witnessed huge inflows of cash into savings, particularly fixed time deposits, with investors looking elsewhere from the stock market in providing safer and guaranteed returns.

Nonetheless, whilst saving rates have risen, cash has been a depreciating asset, after inflation, with ‘real returns’, remaining negative over the long term. So, for many, it is fundamental to have a comprehensive financial plan in place, to ensure your investment and cash allocations are aligned to meet your objectives and goals.

When it comes to investing, however, one particular benefit of holding some money in cash is managing sequencing risk with your investments. This refers to the impact of the timing of investment returns on a portfolio, particularly when withdrawals are made. If an investor needs to sell assets to cover income or emergency expenses, this can significantly affect the overall portfolio value. As such, the benefit of holding some money in cash is that you help reduce the chances of becoming a forced seller during an investment market downturn. By having this safety measure in place, you can help cover some expected or unexpected expenditure without negatively impacting your long-term investment strategy.

If you are interested in exploring what savings accounts have to offer, please check out the Savings Champion website, which compares the best accounts on the market.

Retirement

Holding cash as you approach retirement plays a vital role in providing financial flexibility, security and peace of mind when we consider aforementioned risks with invested pension provisions.

As we have covered, sequencing risk can be a major issue for investors. This risk is more common during retirement, as you are far more dependent on your retirement income through your invested pension pots. Significant market downturns alongside taking pension income could be detrimental on your long-term retirement goals, where cash reserves are not in place, as you could be realising losses that could impact the value of your future pension provisions.

Furthermore, healthcare costs are increasingly forming a large part of unexpected costs during retirement. Health spending per person steeply increases after the age of 50, so having cash buffers in place to cover immediate healthcare needs is important.

Using cash in place of drawing from your pension can also have tax benefits, as some pensions sit outside the scope of inheritance tax. This means that the assets held within a pension fund may not be subject to inheritance tax when passed on to beneficiaries. However, given the complexity of inheritance tax laws, it is recommended to seek advice from professionals who have the expertise to guide you through your estate and pension planning.

If you’d like to learn more about how cash can best play a part in your wealth strategy, why not get in touch and speak to one of our experts.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

Investment returns are not guaranteed, and you may get back less than you originally invested. Past performance is not a guide to future returns.

The Financial Conduct Authority (FCA) does not regulate cash flow planning, estate planning or tax advice.

Savings Champion and their associated services are not regulated by the Financial Conduct Authority (FCA).

Are you overcontributing to your pension?

When building up your pension it is important to be conscious of what limits apply in order to maximise the full tax benefits.

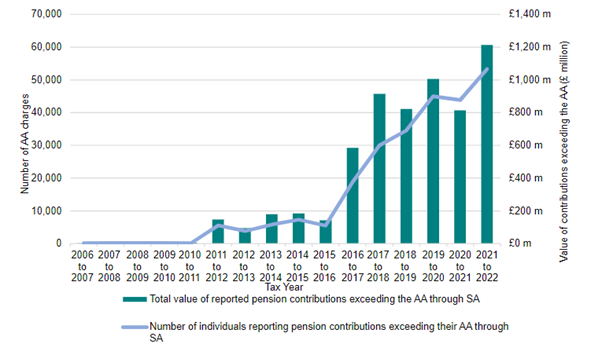

Thousands of people across the UK are experiencing tax charges for overcontributing to their pensions and most don’t even realise. According to HMRC over 50,000 people reported pension contributions that exceeded their ‘Annual Allowance’ (AA) in 2021-2022. This number has been skyrocketing since 2010 and has increased by 10,000 people since 2020-2021, when only approximately 40,000 exceeded their Allowance (Please see chart below).

Figure 1. Number of individuals and value of pension contributions exceeding the AA reported through SA 2006 to 2007 to 2021 to 2022, Source: UK Government

Often people don’t even realise that they are overcontributing until it is too late. So, why are so many people being caught out?

Arrange your free initial consultation

What is an Annual Allowance?

Although there is not a limit on the amount that can be saved into pensions each year, there is a limit on the amount that can benefit from tax relief each tax year. An individuals ‘Annual Allowance’ is the limit that you can contribute to your pension in any tax year whilst benefiting from tax relief. The current annual allowance is £60,000, however, you can only receive tax relief up until your net relevant earnings. Net relevant earnings are the total earnings from salary, bonuses, benefits in kind and trading profits for self-employed individuals in a tax year. So, if your salary is £40,000 for example, you would only receive tax relief up to £40,000, but if it is £80,000, in most cases, you would only receive tax relief up to £60,000 in one tax year.

What if I exceed my Annual Allowance?

If you exceed this allowance in a tax year, any contributions above the limit will typically be subject to an annual allowance tax charge. This excess will be added to your taxable income and be subject to income tax at your marginal rate. In some cases, you might be able to ask your pension scheme to pay the charge from your pension. This is known as Scheme Pays and means your pension would be reduced, but this is not always possible.

Why are people overcontributing?

Although the annual allowance sounds straightforward, there are some caveats that make understanding it a lot more complex. Where your net relevant earnings are more than £60,000 a year and have been a member of a registered pension scheme for more than three years, you may have the ability to use carry forward allowances. If you have not used your full annual allowance from any of the previous three tax years, you can carry this allowance over to the current tax year. This can cause confusion and miscalculations regarding exactly how much more an individual can contribute using carry forward.

Those who have a high income are also subject to more complex rules with regards to their annual allowance. For every £2 of adjusted income (i.e. total taxable income before any Personal Allowances and less certain tax reliefs) that an individual earns over £260,000 their annual allowance is reduced by £1, to a minimum of £10,000. This means that anyone with an income of £360,000 or more has a reduced annual allowance of £10,000.

Another caveat that trips people up is that, in some cases, the annual allowance reduces to £10,000 per tax year when an individual begins drawing down or withdrawing from their pension. This is often triggered for those who are flexibly accessing a defined contribution scheme. It is worth noting this is not the case for all withdrawals, for example when taking a Pension Commencement Lump Sum (PCLS) or annuity. When this reduced allowance comes into effect, carry over cannot be utilised anymore. This can often catch people out and cause them to overcontribute because they think they have more allowance than they do.

It is also worth remembering your annual allowance takes into consideration all contributions to all of your private pension schemes. Therefore, it is not only your personal contributions that count towards the annual allowance, but your employer contributions as well. For those who are fortunate enough to have a Defined Benefit (DB) scheme, otherwise known as a final salary scheme i.e., a pension that traditionally pays out a guaranteed income every year in retirement, calculating the remaining annual allowance is more complex. Any further accrual in a Defined Benefit scheme in a tax year contributes to the annual allowance. These additional complexities make calculating the annual allowance year on year more difficult to understand. As a result, many people find themselves overcontributing and incurring a tax charge without even realising.

Taxation on pension funds has become a hot topic since the 2023 Spring Budget announcement about the intention to remove the ‘Lifetime Allowance (LTA)’. The LTA is the total contributions that one can make to a pension over their lifetime without incurring certain tax charges. Those who weren’t overcontributing prior to this, for fear of exceeding the LTA, have more incentive to re-commence contributions. However, with a general election expected in the autumn of 2024, these changes could be reversed.

If you’re concerned, we can help. With more people than ever exceeding the annual allowance, it is important to be aware of the many factors that need to be considered when calculating how much you should be contributing to a pension. If you have any questions about the annual allowance, or think you might be at risk of a tax charge due to miscalculations; then please get in touch with your Financial Adviser or consider seeking advice.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

The information in this article is based on current laws and regulations which are subject to change as at future legislations.

A pension is a long-term investment. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

The Financial Conduct Authority (FCA) does not regulate tax advice.

How to make your child a millionaire before 40!

Most parents would like to ensure their children have a strong financial footing when they are older, but don’t always know the best way to do this. There are many ways to support your children financially throughout their lifetime, but what if there was a way to make them a millionaire before they even reached retirement age? Here we look at the best ways to put money aside for your children and how you can maximise the benefits of compound interest to make your child a “millionaire”!

Arrange your free initial consultation

The first step to saving for your children’s future is understanding your saving options. Here are the most common options that benefit from tax-free growth:

Junior ISA(JISA)

From the day a child is born you can put money into a JISA for them. The current contribution limit is £9,000 per tax year (or £750 per month) and you have the choice of a Junior Investment ISA or a Junior Cash ISA. The most important benefit of a JISA is that any gains made, or interest earned will be tax-free!

If we assume you receive an average annual net return of 5% per year and you save the maximum of £9,000 every tax year, from the day your child is born until they turn 18, you will have contributed a total of £162,000 to their account. However, due to the magic of compound interest (where you earn interest on interest), they will have a pot of over £265,000 saved in a tax-efficient wrapper, what a great 18th birthday present!

At their 18th birthday they can transfer their JISA into an Adult ISA to continue to receive tax-free interest/ investment returns.

Junior Self-Invested Personal Pension (Junior SIPP)

Setting up a pension up for your children may seem like you are overly preparing but this can actually give your children a significant head start. The maximum you can currently save into a Junior SIPP is £2,880 per tax year, and the UK government will add tax 20% tax relief of £720 per tax year, which would bring the total contribution to £3,600. If you can contribute to your child’s Junior SIPP for 18 years and again assuming a 5% growth rate, you will have contributed £51,840 but their pension pot will be worth £106,340 due to the added tax relief. If your child doesn’t contribute to the pension again, by age 57* they could have a pension pot worth around £712,986. Similar to the JISA, any gains made within the SIPP are exempt from tax, and based on current pension rules, you can take up to 25% as a tax-free lump sum upon reaching retirement age.

Recent statistics released by the Office for National Statistics (ONS) stated how the average pension wealth for all persons in the UK is £67,800 at age 57*, highlighting how starting to save early can set your child up for their future and give them a greater opportunity in retirement or even to retire early.

How to make your child a millionaire!

And this is how to do it! If you do the following and assume a 5% growth rate per annum:

- Open a JISA before your child’s first birthday and contribute £9,000 every year until age 18. This results in a total contribution of £162,000 (18 years x £9,000).

- Open a Junior SIPP before your child’s first birthday and contribute £3,600 (including tax relief) to the Junior SIPP every year up to their 18th birthday. This totals 18 years x £2,880 (or £3,600 with tax relief) which equals £51,840 (£64,800)

This would mean you will have contributed a total of £226,800 (including tax relief) to the JISA (£162,000), and Junior SIPP (£64,800). At age 18 when you stop contributing, they could have a total net worth of £372,191 when taking into account compound interest and growth. If they leave this money invested and continue to achieve 5% per year growth, by age 39 they could have a total net worth of just over £1million (£1,036,911), although the funds in the pension would not be accessible until age 57*.

At that point the pension fund could have grown to £712,986, while the ISA, could be worth £1,782,465 if it remained untouched too - an extraordinary total of almost £2.5m. That is a gift worth giving.

The power of starting to save early

Using the same assumptions as above, with a 5% annual growth rate and maximising both Junior SIPP and JISA contributions until age 18:

| Starting from date of birth | Starting at age 5 | Starting at age 10 | |

|---|---|---|---|

| JISA Value at age 30 | £477,430 | £300,604 | £162,056 |

| Junior SIPP value at age 30 | £190,972 | £120,242 | £64,823 |

| Total Value at age 30 | £668,402 | £420,846 | £226,879 |

This shows the benefits you can provide by starting the process of saving early for your child through compounding the interest or investment returns. This is a representation of how you can save for your children and assumes maximum contributions are made at each birthday, but we understand the circumstances for each parent and child will be different and may require different forms of financial planning, such as monthly contributions instead of lump sums.

Despite the examples above, it is never too late to start. If you would like to understand how, The Private Office can structure savings and investments for you and your children to help provide the whole family with a strong financial future. So why not get in touch for a free initial consultation.

* Based on current pension regulation, where the normal minimum pension age is increasing to age 57 from April 2028.

If you would like to know more about this topic, one of our Partners Kirsty Stone appeared on BBC Radio 4 Money Box live, giving her suggestions in a programme all about saving for children.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

All the calculations in this article assume that lump sum contributions are made for 18 years, from birth, unless otherwise stated, to the 17th birthday and are not adjusted for inflation.

The Financial Conduct Authority (FCA) does not regulate tax or cash advice.

The growth rates provided are for illustrative purposes only. Investment returns can fall as well as rise and are not guaranteed. You may get back less than you originally invested. Investments may be subject to advice fees and product charges which will impact the overall level of return you achieve.

Living to 100 years - are you financially prepared?

The number of individuals aged 100 or older in England and Wales has reached an all-time high.

In September 2023, the Office for National Statistics (ONS) released statistics showing that over the past century, the number of centenarians living in England and Wales has increased 127-fold, shown in Figure 1 below. Figures are reported to have hit a record high of 13,924 centenarians in 2021; of this number of centenarians, 11,288 were women and 2,636 were men.

Figure 1. The number of centenarians in the population increased rapidly from the second half of the 20th century, Source: Historic Census data (1991 to 2021) from the Office for National Statistics

ONS report the UK ranking as the seventh country worldwide for highest number of centenarians and in 2021, the ONS reported that there has been a 24.5% increase from 2011 of centenarians living in England and Wales.

Although an ageing population is a major achievement of modern science and healthcare, the rise in the UK’s ageing population raises concerns around financial planning and retirement readiness.

Arrange your free initial consultation

So, how can living longer affect your own financial planning and retirement readiness?

Whilst the news that an increased number of individuals living longer in England and Wales is good news at the surface level, the challenge to this is that there is a greater need for people to acquire sufficient pension savings to fund a longer retirement.

This issue was identified by the World Economic Forum in 2019, where their findings showed that people may be expected to live longer than the pot of money they have saved for retirement by between 8 to almost 20 years on average. Han Yik, Head of Institutional Investors Industry at the World Economic Forum, stated that “The real risk people need to manage when investing in their future is the risk of outliving their retirement savings”.

Earlier this year, the below estimates were calculated by Interactive investor, using the Pensions and Lifetime Savings Association (PLSA) Retirement Living Standard:

A 65-year-old living to Age 84 would require a starting fund value of £212,000.

Whereas a 65-year-old living to Age 100 would require a starting fund value of £324,000.

These figures indicate that someone expecting to live to 100, compared to the current average life expectancy would need around a further 54% in the starting value of their retirement savings.

It is important to note that these calculations assume that the individual is entitled to the full State Pension of £10,600 p.a. and they also own their home, therefore having no rent or mortgage costs.

Whilst the UK Government provides the State Pension to qualifying individuals, which can provide a solid foundation for retirement, this needs to be supplemented to ensure a genuinely comfortable later life. Although it is technically possible to live on the state pension, additional incomes sources are crucial for a more comfortable and enjoyable retirement. And that’s before the likelihood of further costs to consider such as at-home Care or Care Home needs.

How can you be better prepared for your financial future?

Starting your financial planning as soon as possible brings many benefits including possible higher return on your investments, time to weather market volatility and ability to take more risks.

A key tool used when giving financial advice and looking ahead to your financial future is cash flow modelling. Cash flow modelling helps you to visualise what your future could look like, and then more importantly, what needs to be done before then. For example, it helps you answer questions such as:

- “How much do I need to start saving in order to retire at age 60?”,"If I was to require Care, would I be able to afford it?”, etc.

While we can make sensible assumptions, the one difficult thing to predict is one’s life expectancy. With the general population living far longer, it’s important to take a cautious approach and always overestimate, which is why we usually plan our cash flow models to age 100.

A good place to start planning your future is by understanding where you are now within your financial planning journey and what your life goals and expectations might be. A useful tool to get a basic understanding of this is our retirement calculator. From your own inputs, you will be able to forecast an estimate of the pension income you will get when you retire and receive a target retirement income to aim for based on your choices, taking into account your salary.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

A pension is a long-term investment. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

The Financial Conduct Authority (FCA) does not regulate tax advice or cashflow modelling.

Autumn Statement – what the announcements mean for your finances

Chancellor Jeremy Hunt promised to ‘reduce debt, cut taxes and reward work’ in his ‘Autumn Statement for growth’, but what might the changes he announced mean for your personal finances?

In the lead up to the Autumn Statement, we discussed the changes that were rumoured to have been announced in this article.

Arrange your free initial consultation

These speculated changes included:

- Reducing Inheritance tax

- Announcing an additional ISA allowance for investment into UK companies

- Changing the state pension triple lock calculation to limit next year’s state pension increase

In the end, none of these changes were introduced, with shadow chancellor Rachel Reeves claiming Hunt wanted to reduce inheritance tax but that he “couldn’t get away with it in the middle of a cost of living crisis”. Instead, the headline grabbing change was the 2% reduction to employee national insurance contributions between £12,571 and £50,271. This will equate to an annual saving of c. £754 p.a. to those earning over £50,270 p.a. with effect from January 2024. Additionally, there were National Insurance reductions for the self-employed, with Class 2 contributions effectively abolished and Class 4 contributions reduced from 9% to 8% between £12,571 and £50,271 with effect from April 2024.

However, this will only go part of the way to make up for the impact of the continued freezing of the income tax bands, which will remain frozen until 2028. Indeed, as a result of higher inflation, higher interest rates and frozen tax bands, the Office for Budget Responsibility (OBR) states “Living standards, as measured by real household disposable income per person, are forecast to be 3.5 per cent lower in 2024-25 than their pre-pandemic level.”

Separately, the speculated ISA allowance increase for investments into UK companies did not materialise and pensioners will be pleased to hear Mr Hunt state the government will “honour our commitment in full” as the state pension rises by 8.5% next year.

Regarding pensions, workers will hope a new legal right for their new employer to pay into their previous defined contribution pension scheme will simplify pension planning going forward and will mean an end to the accumulation of multiple schemes as individuals move between companies.

This was an Autumn Statement with half an eye on an upcoming general election, with announcements that should put more money in the pockets of workers and pensioners alike. Mr Hunt repeatedly referred to the OBR’s forecasts during his announcement as he tried to rebuild credibility, a little over a year after Liz Truss and Kwasi Kwarteng’s ‘mini-budget’, prior to which the OBR was not asked to run forecasts. Overall, Mr Hunt will have been grateful that he was able to use some of the fiscal headroom provided by then Chancellor, now Prime Minister, Rishi Sunak’s decision to freeze income tax bands back in 2021 to offer a national insurance cut and significant state pension rise to the voting public.

Arrange your free initial consultation

The opinions shared in this article are solely those of the individual and they do not necessarily reflect those of The Private Office.

What if... you could look into your financial future?

How could cash flow modelling help you? Find out how we can help you plan for your financial future.

What is a widow's pension in the UK?

A partner passing away is, of course, a distressing situation that leaves many wondering how they will cope. As well as the emotional difficulties you face in this situation, you may also be asking how you will be able to support yourself financially. You can find some comfort in the fact that you may be eligible for bereavement support, sometimes known as a widow’s pension, which could be valuable if you were financially dependent on your deceased partner.

This, of course, brings up all sorts of questions, including “who qualifies for a widow’s pension?” and “how much is a widow’s state pension?”. Here we look to answer some of these questions so you know whether you are eligible, how much you could receive, and for how long?

What is a widow's pension?

The term widow’s pension is slightly outdated, as the benefit referred to as the “widow’s pension” was phased out in April 2001 and replaced by Bereavement Support Payments (BSP). However, you might still hear people using the old term to refer to this. BSP is financial support that you receive after the passing of a partner.

The original widow’s pension was available until the widow turned 65, or they remarried or retired. This is a key difference with the modern BSP which is only payable up to 21 months after your partner passes away, or until you reach state pension age.

In addition to the difference in length of payment, BSP is available to all widowed partners (whether married or in civil partnerships), regardless of their gender. Crucially, following a successful debate in the House of Commons in February 2023, this payment by law can now extend to those who were living together, but were not married or civil partners. This previously restricted a large number of couples, but the modernisation of this scheme is welcome and is expected to open the payment up to around 21,000 families to claim.

How much is a widow's pension?

In order to qualify for a Widow’s Pension your partner must have paid National Insurance contributions, or their death must have been related to their job.

Bereavement support payment is paid in monthly instalments, and the amount that you receive will depend on whether you have children or not. Those without children will receive up to £100 every month, whereas this amount can increase to £350 if you have children. This lasts for 18 months.

In addition to the regular widow’s pension, you may also be eligible for a one-off Bereavement Support Payment. This is usually a tax-free lump sum of £2500 but increases to £3500 if you have children.

You do not need to worry about tax with this payment; UK regulations dictate that this support is tax free, while it’s also important to note that it’s not included in the benefit cap. This means that you don’t need to take this into account when you’re applying for any other means-tested benefits. If you get benefits, BSP will not affect your benefits for a year after your first payment. After a year, money you have left from your first payment could affect the amount you get if you renew or make a claim for another benefit.

You must tell your benefits office (for example, your local Jobcentre Plus) when you start getting BSP.

Am I eligible to claim Bereavement Support Payment?

You do not need to be over a certain age to receive Bereavement Support Payments. However, payments cease once you are over state pension age.

To qualify:

- You must be below the state pension age when your partner passed away and living in the UK or another country that pays bereavement support.

- Your partner paid National Insurance contributions for a minimum of 25 weeks within one tax year since April 1975 or died under circumstances relating to their work.

- Your partner must have passed away within the last 21 months. If you do not claim within the first 3 months after their death, then you will not be eligible to receive the full amount.

As it currently stands, Bereavement Support Payments are not means-tested, so if you’re wondering “how much is a widow’s state pension?”, then this only depends on whether you have children or not. You’ll be eligible for the higher rate if you have children that you support.

When should I apply for Bereavement Support Payment?

If your partner died after April 2017, then Bereavement Support Payment is paid for up to 18 months after your spouse or civil partner passed away, so it’s important that you claim as soon as possible to avoid missing out. You must claim within 3 months of your partner passing away to receive the full 18 payments.

How to claim Bereavement Support Payment

To apply for Bereavement Support Payment, you can do so through the UK Government website, by telephone, or via post. You may need to provide details such as your partner’s National Insurance number, proof of death, and bank account information to process the claim.

Can a widow claim pension credit?

Pension Credit is a government initiative that is designed to provide elderly people on a lower income with extra money to cover living costs. To qualify for pension credit, you will be means tested and you must be over the state pension age. In addition, you can get assistance with housing costs such as ground rent and service fees. It’s something that you should factor into your long-term care planning for older age, as it can provide important help to lower income retirees.

Widows are eligible to claim pension credit just like anyone else. Eligibility is based on your age and income, and you may also receive additional support if you are a carer, have a disability or are responsible for a young person. Widow’s pension and bereavement support have no effect on your ability to apply for pension credit. If you get benefits, Bereavement Support Payments will not affect your benefits for a year after your first payment. After a year, money you have left from your first payment could affect the amount you get if you renew or make a claim for another benefit.

So, in summary, a widow’s pension does not actually exist in the UK anymore but has been replaced by Bereavement Support Payments. However, you might find people still call these payments a ‘widow’s pension’. These payments are made in monthly instalments.

Finally, receiving Bereavement Support Payments does not affect your eligibility for pension credit. In fact, the two are mutually exclusive, since only those above pension age can claim pension credit, and only those below pension age can claim Bereavement Support Payments.

If you think you might be eligible for a widow’s pension, but aren’t entirely sure, it may be a good idea to speak to a financial adviser. The Private Office can help you understand your options for retirement and provide you with pension advice that is suited to your individual needs and circumstances. Contact us today to see if we can help.

Arrange your free initial consultation

Pensions are a long-term investment; investment returns are not guaranteed, the value of your investments can go down as well as up and you may get back less than you originally invested.

The information provided in this article is based on the current allowances and legislation and is subject to change.

The Financial Conduct Authority (FCA) does not regulate tax advice.

How to avoid paying tax on your pension

Pensions, like most forms of income, incur taxes. However, there are ways to ensure you’re not unnecessarily overpaying in tax, even when you’ve retired.

Do you pay tax on your pension?

The short answer to this question is yes, so long as your pension exceeds the minimum threshold for paying income tax.

Arrange your free initial consultation

Income from a pension is taxed exactly like any other form of non-savings income. Firstly, everyone has a personal allowance, which is the amount of money you’re allowed to earn each year before you start paying income tax. Currently, the personal allowance is £12,570 (though this may be reduced if you have earnings above a certain level), so if you receive less than £12,570 per annum of taxable income, then you pay no income tax. Once your taxable income goes above this level you become liable to pay 20% income tax on taxable income between £12,571 and £50,270 per annum. This then increases to 40% income tax for taxable income between £50,271 and £125,140, and 45% beyond that. These income tax rates are valid as of 2024. For updated and current tax rates, see our latest tax tables.

It’s worth noting however, under certain circumstances, you do not need to pay tax on all of your pension income. Additionally, there are strategies you can adopt to minimise the amount of tax you pay on your pension.

How much will I be taxed on my pension?

Another frequently asked question is “how much tax do you pay on your pension?”. As stated above, the amount of income tax you pay on your pension depends how much income you draw from your pension.

The good news, is that some of your pension is, in fact, tax free. If you have a defined contribution pension, whereby your pension is based on how much you and/or your employer have saved into it — which is the most common kind — then you can take out 25% of your pension completely tax-free, subject to a max of £268,275, this is known as the Lump Sum Allowance (LSA).

It is important to understand that, although possible, this does not need to be taken out as one single lump sum. It is possible to take out multiple smaller lump sums each with 25% tax-free, or just take portions of tax-free cash over time rather than all at once (known as phasing), as long as your pension allows for ‘flexi-access drawdown’. The remaining 75% will be taxed according to the standard rules explained above.

If you are only receiving the new state pension, on the other hand, then you do not need to worry about income tax. As of 6th April 2024, the full new state pension is £221.20 per week, or £11,502.40 per year — since this amount is within your personal allowance there will be no income tax to pay. Most people who have worked throughout their lifetime will be eligible for a state pension, although the amount you receive will depend on your national insurance record.

However, if you have income from other sources bringing your yearly income higher than £12,570, then you may be expected to pay income tax.

What other forms of tax for my pension should I be aware of?

Income tax is the main tax you can expect to pay on your pension. Previously the lifetime allowance, stood at £1,073,100 and additional tax may have been due if your pension exceeded this limit. However, in the Spring Budget 2023 it was announced that the charge and the lifetime allowance itself would be removed entirely as of the 2024/25 tax year, while a 0% charge would apply to any excess pension above the lifetime allowance in the 2023/24 tax year. There is, naturally, political risk of legislation changing with regard to this tax charge.

The lifetime allowance has now been replaced by the Lump sum Allowance (LSA) and the Lump Sum and Death Benefit Allowance (LSDBA).

How to avoid paying tax on your pension

If you want to mitigate tax on your pension, the only certain way to do it is to ensure that your total taxable non-savings income, including your pension income, is below the personal allowance. However, this will likely not permit you your desired standard of living in your retirement years.

Instead, there are a few tips and tricks for limiting the amount of tax you are liable to pay on your pension. These are outlined below:

Only withdraw the amount you need each tax year

Of course, you should take out as much as you need to live a comfortable life, but you might want to keep an eye on staying within certain tax thresholds. For example, if you are careful to take out no more than £50,270 in the current tax year, including any other income sources, you will only need to pay 20% income tax. However, if you were to take out £50,271 or more, you’d pay 40% on the amount over £50,270, up to the next tax threshold.

Note that at retirement stage, you aren't required to draw down on your pension income to put into savings. This means it can be more financially beneficial to withdraw less, or none, and stay within a low tax range, rather than withdraw more and have to pay substantially more tax.

Take advantage of a drawdown scheme

Drawdown allows you to vary your income from year to year, meaning you can opt to keep it below a certain tax range in a given year. This is not possible for you, however, if you have an annuity, since annuity income cannot be varied at will. Bear in mind that drawdown does come with some risks, so always check with a financial advisor before you pursue it as an option.

Don’t draw your pension in one go

As is evident from the points above, staggering your pension so that you receive less on an annual basis ultimately means you will pay less tax. While you might be tempted to empty your pension pots in one go, it will mean paying income tax on that amount in one year. In most cases, this would be a poor decision from a tax perspective as it may result in your income falling into the higher tax rate bands and triggering a significantly larger tax bill.

Phasing your 25% tax free cash

In the event that you need to draw more than £50,270 from your pension, you would be liable for 40% income tax on any further income until the next tax band or if you go over £100,000 and hit the 60% tax trap. It is possible, in this instance, to take smaller amounts from your tax-free cash to top up your income when you reach these limits. When planned with care, this can be an excellent retirement income strategy to ensure you do not pay higher rates of income tax.

The importance of Pension Freedoms

With the introduction of Pension Freedoms in 2015, this allows far more flexibility for an individual when they come to draw their pensions. An individual can now draw their pension from minimum pension age onwards, when and if they like, in any portion that they like. As well as this flexibility allowing an individual to tailor their income needs around their chosen lifestyle, it also allows far more flexibility with regards to tax planning, including income tax, as well as inheritance tax, which are all intertwined when planning in this nature. It is therefore important that your pension schemes have adopted the Pension Freedoms to ensure that you have absolute flexibility both on drawing an income as well as on death. It is important to note that not all pension schemes have adopted modern flexibilities. If you are unsure, get in touch.

So, the only way to truly avoid paying tax on your pension is to ensure your pension withdrawals (including your state pensions) do not exceed £12,570 per year.

Ways to reduce tax on your pension however include:

- Not withdrawing more than you need from your pension each year.

- Utilising a drawdown scheme so that you can vary your yearly pension income.

- Avoid drawing large pensions in one go.

- Phasing tax free cash.

How can we help?

The Private Office offers expert advice on how best to manage your pension, including how to avoid paying unnecessary extra tax. Get in touch to arrange a free consultation.

Arrange your free initial consultation

This article is intended for general information only, it does not constitute individual advice and should not be used to inform financial decisions.

A pension is a long term investment, the value of investments can fall as well as rise. You may not get back what you invest. Your eventual income may depend on the size of the fund at retirement, future interest rates and tax legislation.

The Financial Conduct Authority (FCA) does not regulate estate planning or tax advice.

Approaching Retirement Guide

Your guide to designing your stress-free retirement