Pensions & Divorce

How to protect your pension in a divorce

There are many rules relating to pensions in divorce settlements that can affect your outcome. Getting independent financial advice early on in the process is recommended.

Specialist, professional advisers can be key in helping clients review their situation objectively as well as helping navigate what may be uncertain territory.

We use Cash Flow modelling and budgeting capability to assess and identify monetary needs and ensure any financial settlement is sufficient for its purpose. With specialist knowledge in ever changing areas such as pension sharing, financial protection and investments, our expert team is here to help you through all stages of the divorce process and help you view the future with confidence.

How to start divorce proceedings

The divorce process starts with the filing of a divorce petition, which is completed by the Petitioner (the individual seeking the divorce). The petition can be completed online or by hand. At this stage you will also need to present your marriage certificate to the court and pay the court fee.

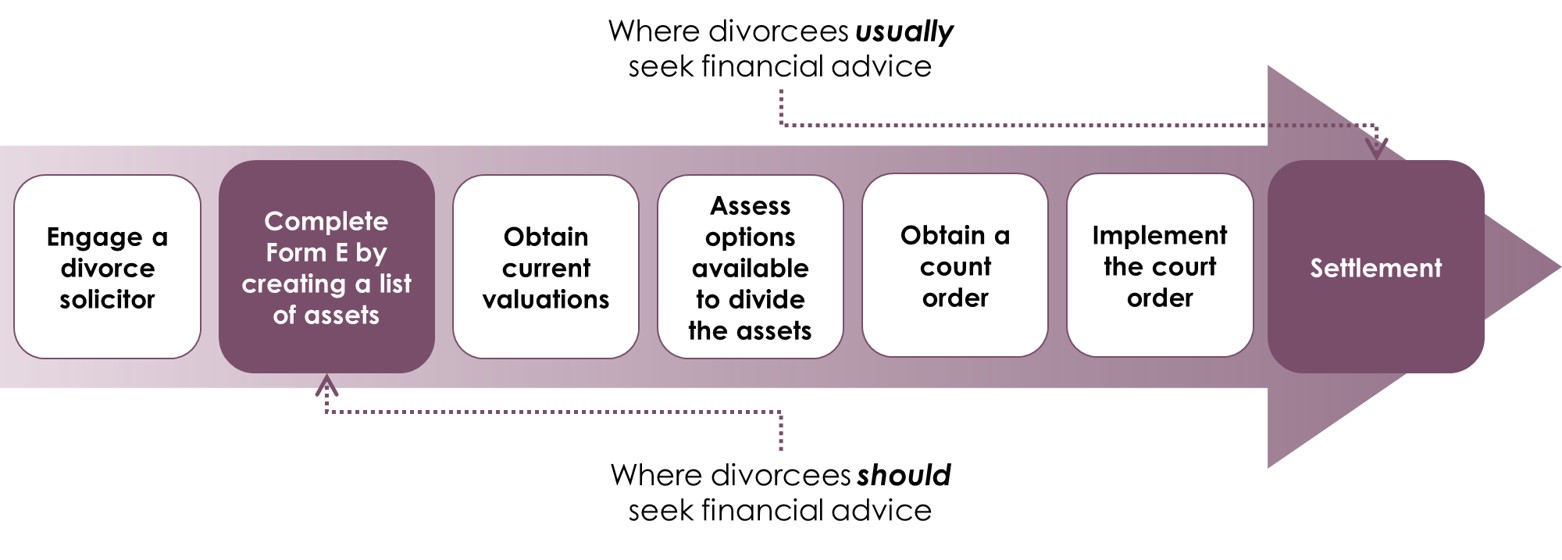

The diagram below shows the typical journey clients go through from implementing divorce proceedings, through to settlement and a division of assets:

In our opinion, far better outcomes may be achieved when appointing a financial adviser much sooner in the process as advice can be provided to help understand tax implications, planning opportunities and most importantly establishing how much capital and income you need to live the lifestyle you wish to live.

This is never more true than where Pensions are involved in the calculations.

Pensions in divorce

One of the most complex areas encountered during divorce negotiations is that of pensions. After the main residence the most significant family asset is quite often accrued in pension entitlement.

Both parties are jointly entitled to pension assets regardless of whether one party to the marriage may have accrued significantly more than the other.

There are a whole host of different technical terms used in reference to pensions on divorce for instance pension sharing, offsetting, earmarking, final salary, defined contribution and so on.

Although your solicitor will be able to provide you with broad guidance in this area the vast majority of solicitors will recommend that you receive specialist financial advice in respect of any pension assets that might become subject to divorce negotiations. We will discuss some of these subjects within the following sections of this article.

However employing the skills of a financial adviser experienced with dealing with pensions on divorce will help to demystify this complexity and make pensions a less scary prospect during divorce negotiations!

The “pension freedom” legislation provides for far greater flexibility in how pension benefits may be drawn and render them even more crucial in delivering a lifestyle post-divorce.

However without carefully considered advice certain unwelcome tax liabilities might arise when drawing benefits. There’s nothing to be scared of, you just need to handle pensions with care!

Types of Pension

There are two broad types of pension product that are encountered today:

- Defined Contribution or Money Purchase pensions – these are pensions which have a capital value linked to the value of the underlying investments.

- Defined Benefit or Final Salary pensions – these pensions provide a guaranteed level of income payable from the scheme’s designated normal retirement age, or sooner if you are willing to accept an early retirement penalty.

When implementing a divorce, it is far easier to achieve independence and a clean division of assets when dealing with defined contribution or money purchase pensions, given that the pension is often a pot of money with a quantifiable capital value.

Where there are defined benefit or final salary pensions involved, the position can be slightly more complicated depending on the rules of the pension scheme(s) and the options they are willing to facilitate.

How is the pension split in a divorce?

Both parties are jointly entitled to pension assets regardless of whether one part to the marriage may have accrued significantly more than the other. With the introduction of “pension freedom” there is now far greater flexibility around how pension benefits can be accessed; this includes offsetting, pension sharing and attachment order.

With these options comes the need to carefully consider the impact each could have on you and your retirement aspirations.

What is the meaning of offset?

Offsetting is arguably the simplest and cleanest method of dealing with pension benefits on divorce. Once the value of all the assets (non-pension and pension) and income have been established, the value of the pension rights can be weighed/offset against other matrimonial assets (such as the family home or other savings).

In essence, the ex-spouse/former civil partner gets another asset, or share of another asset (up to the appropriate value of the share of the pension), instead of a share of the pension.

Before the introduction of pension freedom in 2015 it was unusual for pensions to be assessed on a £1:£1 basis with other marital assets due to restrictions on how the capital could be accessed and the value apportioned could vary greatly depending on the length of time to retirement.

However, for those considering divorce today, where benefits have been accrued in a money purchase pension plan, it is more likely that pension benefits will be valued in parity with non pension assets although the tax implications would need to be addressed as part of the settlement discussions.

How does pension sharing work?

Pension-sharing enables the courts to split pension rights between a husband and wife or civil partners at the time of the divorce. The aim of pension sharing is to separate the ex-spouse’s / former civil partner’s pension entitlement from the member’s pension so that there is a clean break.

When a pension sharing order is issued a ‘pension debit’ will be created in relation to the member’s rights (that is, the amount to be deducted) and an equivalent ‘pension credit’ will be provided for the ex-spouse / former civil partner.

The options available to the ex-spouse / former civil partner will depend on the type of scheme to which the member belonged and the rules of that scheme.

All providers of funded pension arrangements (excluding those transferred to the Pension Protection Fund (PPF) and any pensions already in payment), must allow the ex-spouse / former civil partner to transfer a pension credit to another registered pension scheme of the ex-spouse’s / former civil partner’s choosing, subject to the receiving pension arrangement being able to accept the transfer.

Once transferred, there are generally no restrictions on how pension credit benefits can be taken other than any standard legislative and tax requirements, such as the minimum pension age being met and any rules under the new scheme that may apply.

The pension sharing order may be made where the member has already commenced benefits, for instance where the member has already entered drawdown and taken their tax free lump sum (also known as a pension commencement lump sum or PCLS).

These are called disqualifying pension credits.

Here, the ex-spouse / former civil partner receives the pension credit as an uncrystallised benefit with no entitlement to a tax free cash lump sum.

If they are 55 or over they can put the pension into income drawdown and take income, but will not receive any PCLS.

Care needs to be taken during divorce proceedings as a decision by the Court to award benefits as a series of Uncrystallised Funds Pension Lump Sums (UFPLS) rather than issuing a pension sharing order can have serious tax consequences for the member and restrict their ability to re-build their pension funds as the Money Purchase Annual Allowance will be triggered.

What is an attachment of earnings order?

An attachment order (Earmarking) is an order made by the court which requires a proportion of the pension benefits to be paid directly to an ex-spouse/former civil partner, instead of to the member. It is in effect a form of deferred maintenance.

The benefits continue to be held in the original member’s plan until the member starts drawing an income (and/or when they die), when the benefits will be paid to the respective parties in the proportions required by the attachment order.

The amount is specified at the time of the divorce but either party can apply to the court to have the amount varied.

In practice, an agreement in principle is likely to be made between the parties before being ratified by the court.

Attachment cannot take place without the court’s involvement.

If the member subsequently transfers any of their pension benefits that have been subject to an attachment order, the scheme trustees have to inform the new trustees / providers of the attachment order.

They must also notify the ex-spouse / former civil partner within 21 days of the transfer.

Attachment orders automatically lapse on the death of the member even if the pension was in payment at the time of death. The order will also lapse on re-marriage or death of the ex-spouse.

Pension flexibility may have a significant impact on the application of attachment orders - potentially leaving scope to circumvent the requirements set out in the order, unless the details in the order are very specific in relation to how benefits must be taken from the scheme.

For example, the pension-owning spouse may be able to avoid the payment of the pension income or Tax Free lump sum as set out in the attachment order by choosing to take all benefits as an uncrystallised funds pension lump sum (UFPLS) meaning that there are no pension funds left to crystallise.

Although the attachment order will be lodged with the provider, the member still owns the plan.

This means that the provider can tell the ex-spouse what has happened as they are an interested party but, depending on the wording of the order, it might not be possible to stop the member from accessing the UFPLS.

Annual Allowance Considerations

Pension entitlements also require an understanding of annual and lifetime allowances. An example of a Defined Contribution pension and how this may be treated for both the scheme member and recipient is provided below.

What is the Annual Allowance?

The government has set an annual cap on the value of pension contributions. The current Annual Allowance is £60,000. If you have adjusted income in excess of £260,000 or have accessed another pension plan using one of the new flexible income options introduced in April 2015, your Annual Allowance may be lower.

Abolition of Lifetime Allowance

Before it’s abolition in April 2024, the Pension Lifetime Allowance (LTA) was a limit on the amount of pension benefits an individual could accumulate over their lifetime without incurring an LTA tax charge.

An individual would be ‘tested’ against this allowance at various points in time, such as when they begin taking certain benefits, or when reaching the age of 75 for example.

It was possible to register for Lifetime Allowance Protection if you had built up, or anticipated building up pension funds which would exceed the LTA. Lifetime Allowance Protection took many forms over the years as a new type of protection was made available for eligible pension savings changes whenever the LTA was reduced.

Coinciding with the abolition of the LTA we have seen two new allowances introduced on 6 April 2024.

The Lump Sum Allowance limits the amount of tax free lump sum withdrawals an individual can take from their pension plans during their lifetime. The maximum amount which you can take will typically be £268,275, although some people may be able to take a higher amount; more on this later.

The Lump Sum and Death Benefit Allowance restricts the value of tax free lump sum benefits which can be paid to any beneficiaries who inherit your pension if you die before your 75th birthday. For most people this limit will be £1,073,100.

Although the LTA is no longer with us, if you did apply for one of the many forms of Lifetime Allowance Protection, if the combined value of your pension funds exceeds £1,073,100, you will be able to take a high level of tax free cash from your pension plans than everyone else.

The maximum tax free lump sum you will be able to take will be the same as your entitlement under the old LTA regime. For example, if you have Fixed Protection 2012, your Lump Sum Allowance will be £450,000.

In a similar fashion, for most people with one of the many forms of Lifetime Allowance Protection their Lump Sum and Death Benefit Allowance will be increased to match the level of protection provided by their certificate. So, someone who has Fixed Protection 2012 will have a Lump Sum and Death Benefit Allowance of £1,800,000.

| Settlement type | Annual and Lifetime Allowance Considerations | |

|---|---|---|

| Member | Recipient | |

| Pension Sharing: DC Scheme | Known as a pension debit | Known as a pension credit |

| Primary Protection enhancement factor has to be re-calculated and may be lost if the rights at 05.04.2006 fall below £1.5 million. | Not treated as a contribution for Annual Allowance purposes | |

| Individual Protection 2014 or 2016: May be lost if the value of the fund remaining falls below the relevant threseholds of £1.25 million (IP14) or £1 million (IP16). | From 6 April 2023 Enhanced Protection will not be lost as a result of the transfer. | |

There is no adjustment to the amount of Lifetime Allowance used where funds have been crystalised before a pension debit is applied. Your Lump Sum Allowance and Lump Sum and Death Benefit Allowance (effective from 6 April 2024) will be reduced to take account of the amount of Lifetime Allowance used prior to 5 April 2024. | If payment arises from an Uncrystallised fund the pension credit will be measured against the recipient's Lifetime Allowance. Your Lump Sum Allowance and Lump Sum and Death Benefit Allowance (effective from 6 April 2024) will be reduced to take account of the amount of Lifetime Allowance used prior to 5 April 2024. | |

The position is far more complicated where defined benefit or final salary pensions are involved and the tax considerations are beyond the scope of this article.

Conclusions

Many people get divorced and subsequently seek financial advice.

This is a period where some of the most important financial decisions of your life are being made and it would make sense to engage a financial adviser who has experience in this field earlier in the process, as critical information can be provided to help you achieve a fair financial settlement and a better financial future.

Understanding the legal principles, process and the common mistakes of designing and agreeing a financial settlement is essential.

Our experience in this field is extensive and has proven very valuable to our clients. if you would like any help in this area please get in touch to arrange a free initial consultation.

Arrange a free initial consultation

The Financial Conduct Authority does not regulate cashflow modelling.

The information contained within this article is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

The information is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.