What is the average retirement income in the UK?

On face value the question of ‘what is the average’ is a simple one, the answer is £561 per week (£29,172 p.a.) for a retired couple and £267 per week (£13,884 p.a.) for a single retiree as per the most up to date Government Pensioners’ Income figures.

However, these figures do not take into account that everyone’s retirement looks different and so the question of ‘what is the average retirement income in the UK’ shouldn’t be boiled down to an annual figure and should be looked upon through a personal more subjective lens.

Arrange your free initial consultation

Retirement Living Standards in the UK

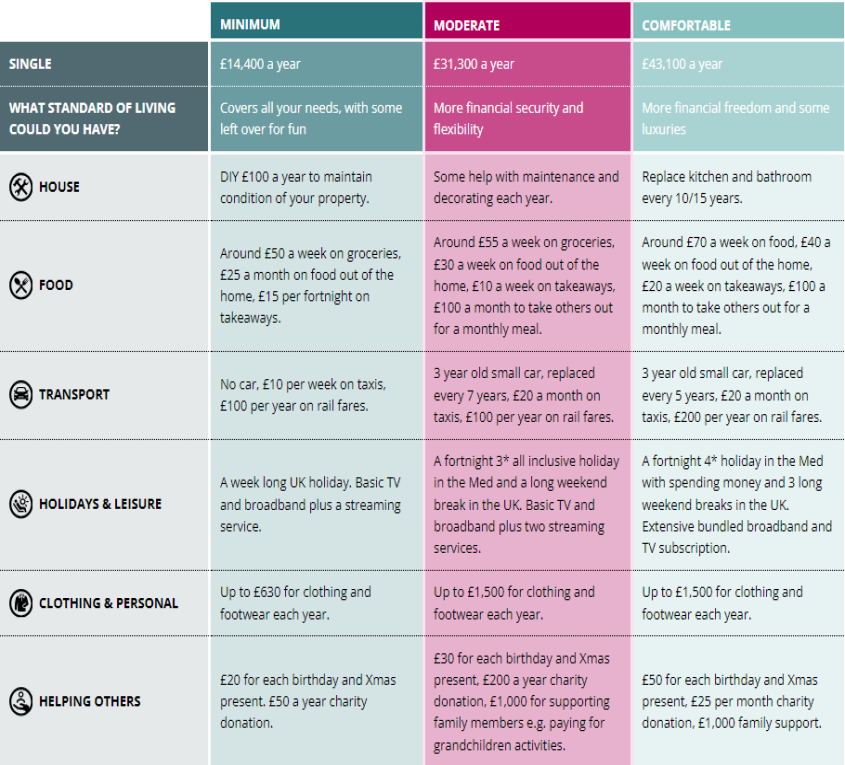

The Pensions and Lifetime Savings Association have conducted a study using independent research provided by Loughborough University which looks into Retirement Living Standards in the UK. The study looks at average retirement income in a more lifestyle focused manner by outlining examples of what specific retirement income groups could look like in more tangible ways. The groups are split into Minimum, Moderate and Comfortable and can be seen below for both single retirees and couples.

Figure 1 - Types of expenditure - Single, Source: Pensions and Lifetime Savings Association, 2024

Figure 2 - Types of expenditure - Couple, Source: Pensions and Lifetime Savings Association, 2024

*The figures shown are the amounts of annual expenditure required to achieve the living standard (ie they are not gross income figures).

These tables suggest possible lifestyles which could be achieved at different levels of income in retirement. Although this is an attempt to address the average retirement income through real world examples of expenditure, the truth is that retirement income is subjective and truly depends on the individual’s circumstances and desires.

The individual nature of retirement income is incredibly prevalent, with the heightened cost of living and uncertainty within investment markets. All in society are experiencing a squeeze on their standard of living as a result of the current situation, and this is particularly impactful for those approaching or at retirement. Those who are used to living a ‘comfortable’ retirement may now be in a position which is more aligned to a ‘moderate’ retirement. These figures have increased dramatically since last year ranging from a 12.5% to 15.5% increase for a single person and 8.3% to 12.5% for couples, which emphasises the need to think ahead to the type of retirement you want and start engaging in planning early on.

What is the average retirement income for a single person?

As shown in the table above, the average retirement income varies from a minimum income of £14,400 a year to £43,100 a year for a comfortable retirement. Again these figures are simply estimates and examples of what you could expect as a lifestyle with the corresponding retirement income figure.

What is the average income for a retired couple?

The figures for a retired couple start at £22,400 and rise to £59,000 using the tables by Retirement Living Standards. With regards to the couple's expenditure, there are additional factors which can impact the level of income you may need. For instance, couples with dependents may have further financial commitments and a different lifestyle to those with no dependents drawing the same level of income.

How much income do I need in retirement?

For many people, private and state pensions could go a long way to building up retirement income. The full state pension for 2024/25 was £11,502 per year. Additionally, adopting the right tax-efficient strategy for your situation could make all the difference. It could be that different pots of savings and pensions are drawn down on at different stages to get your target income to fund the lifestyle you are looking for. Everyone's “need” in retirement will be different, but it should be reflective of what is achievable and affordable within the savings and pensions you have amassed.

Retirement Calculator

A useful tool to get a basic understanding of this is our retirement calculator. From your own inputs, you will be able to forecast an estimate of the pension income you will get when you retire and receive a target retirement income to aim for based on your choices, taking into account your salary.

How to increase your retirement income

Increasing your retirement income is certainly achievable with appropriate planning and foresight; we are massively incentivised by the government to save for retirement through the tax relief on pension contributions and the legal obligation for your employer to pay into a workplace scheme. Taking advantage of these reliefs and putting money aside as early as possible for your retirement can have a real tangible impact on your retirement income.

Additionally, pension funding is the only allowance which can be backdated for up to three tax years, known as Carry Forward – meaning any of your unused allowance from previous tax years can be brought forward and invested into your pension. If you want to read more about building a pension pot and the carry forward rule, read our article “The forgotten allowance – use it or lose it”.

Furthermore, to fund whatever retirement income your lifestyle needs, you don’t need to solely rely on pension savings and the State Pensions. ISAs, cash and other investment vehicles can also be used to fund your retirement. ISAs are particularly useful with their tax-free status, allowing you to draw tax free income when you need it.

We are lucky that we now have more information and more choice on how we plan for the future. A good starting point is to try and envisage what a good retirement will look like you for. This will in turn enable you to ensure you are maximising the relief and allowances which are inherently designed to increase the level of retirement income you can enjoy. Starting retirement saving late shouldn’t be disregarded, as any effort to put away money can have a noticeable difference and impact the retirement you can look forward too.

How does the average retirement income compare to average earnings?

Pre-retirement expenditure needs can vastly differ from your income requirements in retirement. The mean average salary for full-time workers in the UK (male and female) in 2023, according to the Office for National Statistics was £42,210 p.a. As we have investigated, this is significantly higher than the average retirement income for a single individual of £13,884 p.a.

In retirement people often face different expenses compared to their working years. While some costs like commuting may decrease, healthcare and long-term care costs can rise. Furthermore, one of the largest outgoings individuals face whilst working is mortgages. Retirees will generally have paid off their mortgage liability as they begin to transition towards their sources of retirement income to fund their lifestyle. Therefore, the income needed in retirement will inevitably differ from working years.

A standard measure that can be used to assess retirement needs is the replacement ratio, which is the percentage of pre-retirement income that is replaced by retirement income. As a rule of thumb, most people may need to replace between 60%-80% of their pre-retirement household income, before tax, in order to maintain their lifestyle in retirement. However, the average retirement income is far lower than 60% of the average income for full-time workers in the UK (60% of £42,210 is £25,326). Therefore, this serves to reinforce the notion that retirement income is circumstantial for each individual, depending on their unique needs and objectives. The gap between retirement income and average earnings underscores the importance of planning and saving for retirement to ensure financial security and maintaining a desired lifestyle in retirement.

Summary

In summary, we have shown what an average retirement income is according to the Pensions and Lifetime Savings Association, along with three example lifestyles and what these are made up of. However, retirement is personal and is not just as straightforward as a number given to you. Retirement is something to be enjoyed after years of working and how you choose to spend that time and what you choose to do at that stage in life drives the behaviour you need to adopt now, to give yourself every chance of having the future you want.

If you consider what your retirement might look like in advance you can plan, utilise allowances and the tax reliefs granted to you by the government to build your wealth, which you can later draw on to fund your retirement. Starting investing as early as possible also allows for the benefit of compound interest, making even small efforts potentially grow into more sizeable pots.

Here at TPO we use cash flow modelling to visualise retirement for our clients and track their progress towards their goals. This process maps out your financial future and shows you the difference even small changes can make. We will assist you in constructing a tax-efficient strategy to achieve the level of retirement income you hope to gain. If you would like to have an initial free consultation to discuss your retirement plan, please get in touch.

Arrange your free initial consultation

Please Note: The value of investments can fall as well as rise. You may not get back what you invest. The Financial Conduct Authority (FCA) do not regulate estate or cash flow planning, or tax advice.