5 key benefits of an ISA

Individual Savings Accounts (ISAs) are one of the more popular ways for people in the UK to save and invest their money, offering a simple and tax-efficient way to grow your wealth. First launched in 1999, many savers have amassed a small fortune in these tax-free havens, with some becoming ISA millionaires. The flexibility and tax advantages make ISAs especially appealing in today’s economic climate, where tax bills continue to rise. So, choosing an ISA could go some way to minimise your tax burden while you work to build your financial future.

Arrange your free initial consultation

What is an ISA?

Commonly referred to as an ISA, an Individual Savings Account allows you to hold savings and investments without paying tax on income or capital gains. There are four types of ISA available:

- Cash ISA

- Stocks & Shares ISA

- Innovative Finance ISA (IFISA)

- Lifetime ISAs (LISAs)

The ISA allowance, which is the most an individual can save into an ISA each tax year, is currently £20,000. You can split your allowance across the different types of ISAs, for example saving £10,000 into a Stocks & Shares ISA and £10,000 into a cash ISA, which includes a maximum of £4,000 which can be contributed to a LISA.

With the majority of ISAs, you can pay into as many of the same type of ISA in the same tax year, however it is important to note that LISAs and JISAs are an exception to this. You can only ever hold one LISA or JISA in a tax year.

A Junior ISA (JISA) can also be opened for children under the age of 18 and can be either cash or investment based. The savings limit for Junior ISAs is currently £9,000 per child per tax year, and this is in addition to the adult ISA allowance. So even if you are saving cash into the JISA for your child, as that money is now theirs, any money you deposit for them does is not deducted from your own ISA allowance.

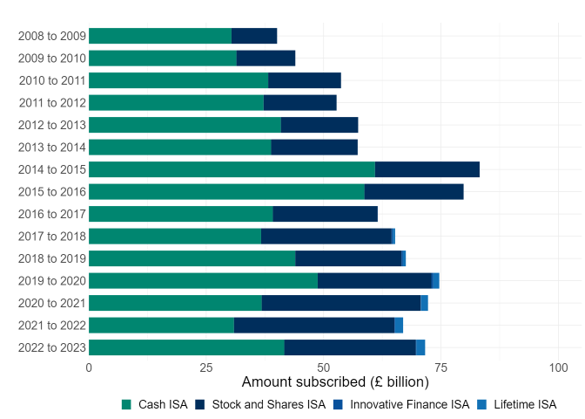

Around £72 billion was subscribed into adult ISAs in the 2022/23 tax year alone across 12 million ISA accounts, which is an increase of £4.7 billion compared with 2021 - 2022. Up to the end of 2020/21 tax year there was an increasing trend towards the use of Stocks & Shares ISAs in the search for greater financial return with interest rates at rock bottom levels. Since the start of 2022 however, we have seen a steady increase in interest rates, making Cash ISAs a more attractive proposition due to the beneficial tax treatment of interest received (explained in more detail below).

Figure1: Number of Adult ISA accounts subscribed to per tax year, (Source: Gov.uk, 2024)

5 main benefits of an ISA

1. Banks or building societies used to automatically take off 20% basic rate tax from any savings interest.

Now, most people have a personal savings allowance (PSA) (with the exception of additional rate taxpayers), which means basic rate and higher rate taxpayers can receive tax-free interest of £1,000 and £500 per tax year, respectively. Above these tax-free thresholds, and on all interest received by additional rate taxpayers, interest received outside of an ISA is subject to an individual’s marginal rate of income tax. However, within an ISA, any interest received is sheltered from income tax. With interest rates payable on savings accounts increasing, the likelihood of interest received on savings outside a Cash ISA breaching your personal savings allowance increases too, so any money outside of the ISA accounts allowance would be subject to income tax, making Cash ISAs a more useful tool in tax mitigation for cash-based savings, particularly for higher rate taxpayers and especially for additional rate taxpayers who have never had a personal savings allowance.

2. Capital Gains Tax: Reduced annual allowance and increased tax rate

In an attempt to help repair public finances and increase the Government’s tax take, Chancellor Jeremy Hunt announced in his Autumn Statement in November 2022 that there would be a reduction in the Capital Gains Tax annual exempt amount for an individual from £12,300 in the 2022/23 tax year to £6,000 in the 2023/24 tax year and then once again to just £3,000 in the 2024/25 tax year.

Added to this, the current Chancellor, Rachel Reeves, announced in the Autumn Budget 2024 that Capital Gains Tax would increase, from 10% to 18% for a basic rate taxpayer and 20% to 24% for higher and additional rate taxpayers for any capital gains above the tax-free threshold. So, anyone selling a buy to let property, for example, saw their allowance plummet and now potentially tax rate increase, and so subsequent tax bills rise. Whereas anyone who has money within a Stocks and Shares ISA wrapper will be able to benefit from any capital gains from profits made on investments being sheltered from Capital Gains Tax.

3. Dividend Allowance reduced

A further allowance that was reduced following Mr Hunt’s Autumn Statement was the Dividend Allowance, which is the amount of dividend income you do not have to pay tax on. This fell from £2,000 per individual in the 2022/23 tax year to just £1,000 in 2023/24 and then £500 in 2024/25. Above the tax-free dividend allowance, basic rate taxpayers must pay 8.75% on any dividends, higher rate taxpayers must pay 33.75% and additional rate taxpayers 39.35%. If you have a Stocks & Shares ISA, you do not pay tax on any dividends received.

4. Withdrawing funds from both Cash and Stocks & Shares ISAs tax free

Alongside sheltering any income or capital gains from tax, you can withdraw funds from both Cash and Stocks & Shares ISAs tax free and typically without incurring a penalty (unless you have fixed-rate account within a Cash ISA).

5. Easing the administration burden

Lastly, not only can ISAs help to reduce your tax burden, but they can also help to ease the administrative burden of completing a tax return or in some cases negate the need to complete a tax return altogether.

Points to Consider

Unlike the amount you are able to contribute into a pension each year (the Annual Allowance), you are not able to ‘carry forward’ any unused ISA allowance from previous tax years. Therefore, if part or all of an ISA allowance for a tax year isn’t used by the 5th April deadline, it’s lost. ‘Use it or lose it’.

Furthermore, as the name would suggest, an ISA is an individual account, hence it cannot be transferred or shared during your lifetime, and likewise any unused allowance cannot be passed to a spouse or partner.

The amount that has been saved into an ISA can be transferred to a spouse or civil partner after your death, with the surviving partner retaining the tax-efficient status of an ISA (the surviving partner will inherit a one-off additional ISA allowance known as the ‘Additional Permitted Subscription’). ISAs do form part of your estate for Inheritance Tax purposes and are potentially subject to Inheritance Tax on death. This differs from pension funds which can be an Inheritance Tax-efficient vehicle for passing on wealth to future generations. From April 2027, most pension funds will form part of your taxable estate for inheritance tax when you die. HMRC are consulting on how the inheritance tax should be collected and this will potentially change the duties of Personal Representatives.

It is important to consider that for cash-based savings, the interest rates offered by ordinary savings accounts can sometimes beat the returns offered by Cash ISAs, even after accounting for the potential tax liability payable. Therefore, Cash ISAs might not always be the best option for savings.

Can I lose money in an ISA?

The level of risk in an ISA largely depends on the type of ISA and the investments you choose. Cash ISAs are typically considered safe, as your initial deposit is secure, but the returns may be lower and subject to inflation. Stocks and Shares ISAs, on the other hand, carry the potential for higher returns but also come with the risk of losing money if the market performs poorly. Innovative Finance ISAs can offer higher interest rates but also involve risks like borrower defaults. Understanding these differences can help you choose an ISA that aligns with your financial goals and risk tolerance.

How We Can Help

If you would like to learn more about how you can make use of your ISA allowance to build wealth tax efficiently, or if you would value a review of any existing ISA arrangements, why not get in touch with us and arrange an initial free consultation today with one of our expert advisers.

Arrange your free initial consultation

The information contained within this article is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

The information is based upon our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.

The value of investments can go down as well as up, you may not get back what you originally invested. The FCA does not regulate tax, estate or cash flow planning.